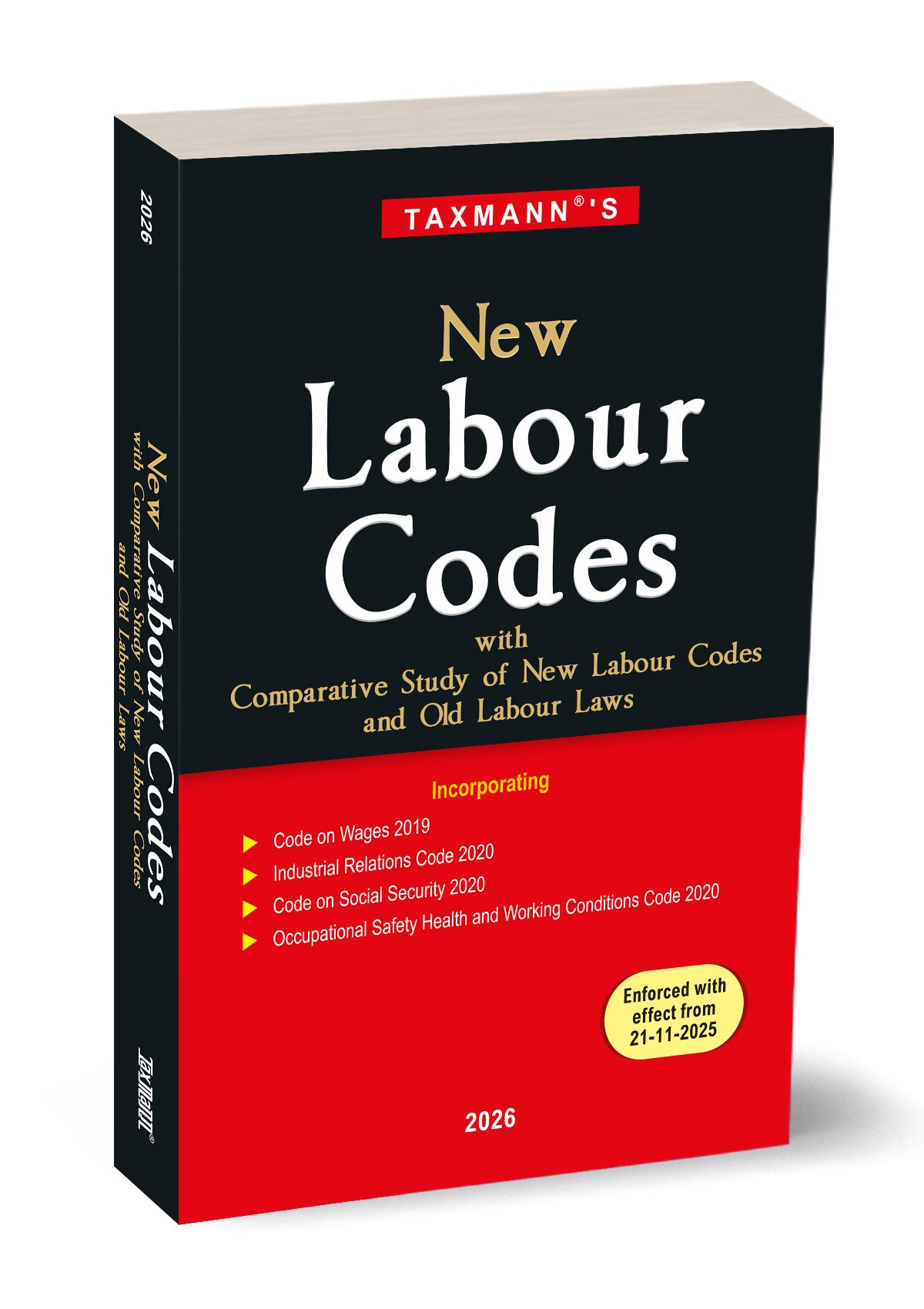

Taxmann’s New Labour Codes with Comparative Study of New Labour Codes and Old Labour Laws Editon 2026

Original price was: ₹595.00.₹520.00Current price is: ₹520.00.

Out of stock

Description

New Labour Codes with Comparative Study of New Labour Codes and Old Labour Laws is a comprehensive, transition-ready statutory reference presenting the complete text of India’s four consolidated Labour Codes—Code on Wages 2019, Industrial Relations Code 2020, Code on Social Security 2020, and the Occupational Safety, Health and Working Conditions Code 2020—as enforced from 21st November 2025. What distinguishes this Edition and makes it indispensable is its exhaustive, carefully structured, and analytically rich Comparative Study of the New Labour Codes vis-à-vis the 29 Central Labour Acts they repeal. This comparative framework spanning more than 100 pages has been designed to ensure that readers can clearly understand the legal transformations, navigate transitional challenges, and interpret how long-established labour-law provisions have been merged, expanded, modernised, or omitted under the new regime. This book serves as a statutory compendium and a practical roadmap for adapting to India’s most extensive labour-law reform since Independence.

This Edition is designed for all stakeholders who require deep-domain clarity and high-precision statutory referencing, including:

- Labour & Employment Lawyers, Legal Advisors, Industrial-Relations Consultants & Litigators dealing with Code-based disputes, compliance audits, and transition matters

- HR Directors, IR Managers, Compliance Heads & Payroll Teams responsible for implementing Code-aligned HR policies, wage structures, and factory/establishment compliance frameworks

- Government Officers, Labour Inspectors, Commissioners & Enforcement Authorities working within the new governance, inspection, and adjudicatory architecture

- Trade Unions, Worker Associations & Employee Bodies assessing changes in the rights, protections, and settlement mechanisms

- Academics, Researchers, Law Faculty Members & Students (LL.B., LL.M., HRM, MBA) seeking an authoritative study resource on India’s new labour governance landscape

- Corporate Policy Teams, CHRO Offices & Industry Bodies preparing workforce transition strategies

The Present Publication is the Latest 2026 Edition, updated till 21st November 2025. It is authored/edited by Taxmann’s Editorial Board, with the following noteworthy features:

- [The Most Exhaustive Comparative Study Available in India] The Comparative Study spanning 100+ pages is the intellectual core of this Edition. It provides:

- Section-wise, Clause-wise Mapping – Each provision of the new Codes is meticulously compared with the corresponding sections of the repealed Acts (e.g., Minimum Wages Act, ID Act, EPF Act, ESI Act, Factories Act, CLA, BOCW Act, Mines Act, ISMWA, etc.).

- Precise Notes on What is New, Omitted, Merged, or Expanded – Examples include:

- New Worker Re-Skilling Fund under IRC Section 83

- Mandatory electronic wage payment for contract labour under OSHWC Section 55

- Significant increases in applicability thresholds (e.g., 100 → 300 workers in IRC Section 77)

- New unified provisions on misuse of social-security benefits under Section 148 of the SS Code

- Practical Policy Impact Assessments – These comparative notes explain:

- Why certain provisions were restructured

- How obligations shift among the employer, contractor, and principal employer

- Which legacy compliance requirements are eliminated or absorbed

- Transition Tool – Readers are guided through how India’s fragmented labour-law landscape, built over eight decades, is consolidated into a modern, streamlined, compliance-oriented regime

- [Complete, Updated Text of All Four Codes] After the comparative blocks, each Code is presented in full (Divisions One to Four), with:

- Arrangement of sections

- Statutory language in authoritative format

- Notifications and applicable Rules (e.g., Code on Wages Central Advisory Board Rules, 2021)

- Clear typography designed for rapid legal reference

- [Practical Interpretation Embedded Throughout] The comparative portions contain interpretative value rarely found in bare-act compilations. Examples include:

- Clarification that Section 148 of the Social Security Code broadens action against misuse of benefits (something the old EPF, MB, CLA, etc. lacked)

- Explanation that OSHWC Code Section 53 shifts welfare responsibility firmly to the principal employer, an important departure from CLA Section 20

- Removal of ‘Labour Courts’ references across various IR Code sections (e.g., Sections 94–95), reflecting structural changes to adjudication systems

- These insights elevate the book from a mere statutory collection to an expert-level reference tool

- [Policy, Philosophy & Reform Context] The comparative study opens with a contextual summary referencing the Second National Commission on Labour (2002) and its recommendation to consolidate 29 Acts into four Codes, a framework later adopted by the Central Government. This helps readers understand the why behind the restructuring, not merely the what

The coverage of the book is as follows:

- Comparative Study

- Code on Wages

- Uniform definition of wages

- New floor wage concept

- Expanded bonus-related changes

- Consolidation of four earlier Acts

- Procedural rationalisation

- Industrial Relations Code

- Shift in strike/lockout notice framework

- New Worker Re-Skilling Fund (Section 83)

- Higher thresholds for retrenchment/closure

- Removal of Labour Court references

- Consolidation of three key Acts

- Code on Social Security

- Unification of EPF, ESI, MB, PG, EC, UWSS and others

- Action against misuse of benefits (Section 148)

- Platform worker & gig worker coverage

- Strengthened governance mechanisms

- OSHWC Code

- Consolidation of 13 major safety/welfare Acts

- Principal employer’s direct obligation for welfare facilities (Section 53)

- Electronic wage payments (Section 55)

- New criteria for prohibiting contract labour (Section 57)

- Introduction of experience certificate requirements (Section 56)

- Code on Wages

- Divisions Containing Full Text of All Codes

- Each Code follows with:

- Arrangement of sections

- Text of the Act

- Notifications

- Relevant Rules

- Each Code follows with:

The book follows a four-part architecture designed for effortless transition management:

- Comparative Study

- Division One – Code on Wages

- Division Two – Industrial Relations Code

- Division Three – Code on Social Security

- Division Four – OSHWC Code

- This framework allows readers to begin with differences, then move to the actual law

Additional information

| BINDING | PAPERBACK |

|---|---|

| EDITION | 2026 |

| LANGUAGE | English |

| ISBN | 9789375616702 |

| PUBLICATION | TAXMANN PUBLICATIONS |

![INDIA’S CONSTITUTION-ORIGINS & EVOLUTION VOL. 4 [ARTS 52-78 & ARTS 153-167] by Samaraditya Pal](https://bharatlawhouse.in/wp-content/uploads/2021/10/9789351434139-295x300.jpg)

Reviews

There are no reviews yet.