-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

How to Handle Income Tax Problems by Narayan Jain & Dilip Loyalka (In 2 vols) 2022 Edn

- Original price was: ₹5,995.00.₹4,495.00Current price is: ₹4,495.00.

- Book Corporation How To Handle Income Tax Problems By Narayan Jain Book Corporation How To Handle Income Tax Problems By Narayan Jain Description This award-winning book provides a comprehensive coverage to the complex subject of Income Tax and gives easy solutions to problems faced by tax-payers. The book gives practical solutions to income-tax problems arranged Section-wise. It incorporates the latest…

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

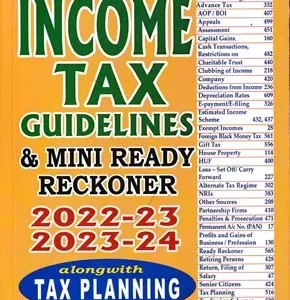

INCOME TAX GUIDELINES AND MINI READY RECKONER 2022-23 AND 2023-24

- Original price was: ₹690.00.₹587.00Current price is: ₹587.00.

- Add to cart

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

INCOME TAX LAW, VOLS. 1-10 (SECTIONS 1-298 AND SCHEDULES ALONG WITH I T RULES, 1962 WITH APPENDED FORMS AND D T VIVAD SE VISHWAS ACT AND RULES, 2020 ALONGWITH ALLIED RULES, SCHEMES, ETC.), 7th EDITION

- Original price was: ₹29,500.00.₹19,175.00Current price is: ₹19,175.00.

- Chaturvedi and Pithisaria’s, Income Tax Law has carved a niche for itself as an authentic and comprehensive treatise on income tax law. This work embodies systematised analysis of the principles of income tax law on one hand, while imparting practical guidance on the other. Various facets of the law have been addressed with precision and clarity, accompanied by ample illustrations.…

- Add to cart

-

- Sale!

- INTERPRETATION OF STATUTES, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

INTERPRETATION OF INDIRECT TAX STATUTES INCLUDING GST

- Original price was: ₹3,399.00.₹2,550.00Current price is: ₹2,550.00.

- Keynote This book provides readers with the way courts have interpreted indirect tax statutes with reference to case laws, sections and delegated legislation. Arranged under major concepts, the insight provided will be beneficial to judges, justices, practitioners, tax officials and to law colleges. Description Highlights of the book – Concepts of interpretation of tax statutes lucidly explained – An exclusive…

- Add to cart

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

JYOTI RATTAN- TAXATION LAWS

- Original price was: ₹895.00.₹715.00Current price is: ₹715.00.

- Bharat’s Taxation Law (As per Assessment year 2021-22) by Dr. Jyoti Rattan – 13th Edition 2021. Bharat’s Taxation Law (As per Assessment year 2021-22) by Dr. Jyoti Rattan – 13th Edition 2021. About TAXATION LAWS INCOME TAX Chapter 1 Introduction [Sections 1-4] Chapter 2 Residential Status and Total Income [Sections 5-9] Chapter 3 Exempted Income [Sections 10-13B] Chapter 4 Agricultural Income [Section 2(1A)] Chapter 5 Computation of Total…

- Read more

-

-

- Out of StockSale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

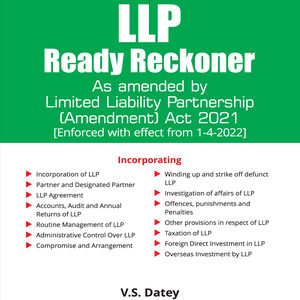

LLP READY RECKONER (ENFORCED WITH EFFECT FROM 01/04/2022) EDITION 2023

- Original price was: ₹895.00.₹670.00Current price is: ₹670.00.

- Taxmann’s LLP Ready Reckoner as amended by the Limited Liability Partnership (Amendment) Act 2021 & updated till 1st April 2022 by V.S. Datey – Edition 2023. Taxmann’s LLP Ready Reckoner as amended by the Limited Liability Partnership (Amendment) Act 2021 & updated till 1st April 2022 by V.S. Datey – Edition April 2022. Description This book is a subject-wise practical guide…

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Law & Practice by CA Manoj Kumar Goyal

- Original price was: ₹2,995.00.₹2,097.00Current price is: ₹2,097.00.

- LMP’s GST Law & Practice (Amended by the Finance Act 2022, and updated till 20th April 2022) by CA Manoj Kumar Goyal – 1st Edition May 2022. LMP’s GST Law & Practice (Amended by the Finance Act 2022, and updated till 20th April 2022) by CA Manoj Kumar Goyal – 1st Edition May 2022.

- Add to cart

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Manufacturing in Customs Bonded Warehouse By Raveendra Pethe, CA Amrendra Chaudhri, CS, LLB Sunil Kumar Rajesh Ingale Edition 2022

- Original price was: ₹1,495.00.₹1,120.00Current price is: ₹1,120.00.

- Manufacturing in Customs Bonded Warehouse By Raveendra Pethe Manufacturing in Customs Bonded Warehouse By Raveendra Pethe HIGHLIGHTS OF THE BOOK The book covers discussion on the legal provisions regarding manufacturing in a bonded warehouse Covers legal provisions related to warehousing The discussion covers the procedures and instructions circulated by the Board and the Commissionerates Provides references supporting the discussions Wherever possible…

- Add to cart

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

MEHTA’S INCOME TAX READY RECKONER (AY 2022-23 & AY 2023-24)

- Original price was: ₹1,400.00.₹1,120.00Current price is: ₹1,120.00.

- VG Mehta’s Income Tax Ready Reckoner by NV Mehta – Assessment Year 2022-2023 & 2023-2024.

- Read more

-

-

- Out of StockSale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, MSMEs, START-UPs, INDUSTRIES, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

MSME READY RECKONER

- Original price was: ₹1,795.00.₹1,350.00Current price is: ₹1,350.00.

- Micro Small & Medium Enterprises (‘MSME’) Ready Reckoner is a comprehensive book on laws governing MSMEs in India. It provides an analysis of all the provisions of the MSME Act, 2006, along with relevant Circulars & Notifications, illustrations, case studies, etc. This book is divided into eights divisions, namely: MSMEs – Definition, Classification and Registration Benefits to Registered MSMEs Benefits…

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

MYSTIQUES OF MLI BROUGHT ALIVE

- Original price was: ₹1,095.00.₹875.00Current price is: ₹875.00.

- Add to cart

-

- Out of StockSale!

- SUPREME COURT, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Oakbridge’s Tax, Constitution and the Supreme Court by Karthik Sundaram

- Original price was: ₹795.00.₹635.00Current price is: ₹635.00.

- Oakbridge’s Tax, Constitution and the Supreme Court by Karthik Sundaram – 1st Edition 2022. Oakbridge’s Tax, Constitution and the Supreme Court by Karthik Sundaram – 1st Edition 2022. Key Features : Tax, Constitution and the Supreme Court discusses the fundamental principles of taxation as expounded by the Supreme Court through its judicial pronouncements from 1950 till date in a simple…

- Read more

-