Sale!

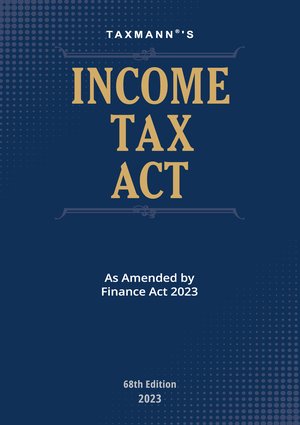

Taxmann Income Tax Act 68th Edition 2023

Original price was: ₹2,375.00.₹1,780.00Current price is: ₹1,780.00.

Out of stock

Description

This book covers the amended, updated & annotated text of the Income-tax Act 1961 & the Finance Act 2023.

The recent changes in the Income-tax Act, 1961 are as follows:

- [Insertion] of 5+ new sections

- [Important New Sections] include:

- Section 50AA – Special provision for computation of capital gains in case of Market Linked Debenture and specified mutual funds

- Section 80CCH – Deduction in respect of contribution to the Agnipath Scheme

- Section 115BAE – Tax on income of certain new manufacturing co-operative societies

- Section 115BBJ – Tax on winnings from online games

- Section 194BA – TDS on winnings from online games

- [Important New Sections] include:

- [Amendments] in 115+ sections

- [Important Amendments] include:

- Taxation of life insurance policies

- The new avatar of the alternative tax regime of Section 115BAC

- Rebate under Section 87A allowed to the individuals opting for the alternative tax regime

- Increase in the rate of TCS on remittance under LRS

- Changes in the provisions relating to the taxation of charitable trusts and institutions

- Deduction for the sum payable to micro and small enterprises to be allowed on a payment basis

- The threshold for presumptive tax scheme under Section 44AD and Section 44ADA has been increased

- Interest claimed as a deduction will not form part of the cost of the acquisition

- Taxation of a sum received by a unit holder from the business trust

- Change in the limitation period for completion of assessment

- A new authority for appeals is created at Joint Commissioner (Appeals)

- Increase in the tax on royalty and FTS income of non-residents and foreign company

- [Important Amendments] include:

The Present Publication is the 68th Edition and has been amended by the Finance Act 2023. This book is edited by Taxmann’s Editorial Board, with the following noteworthy features:

- [Coverage] of this book includes:

- Division One – Income-tax Act, 1961

- Arrangement of Sections

- Text of the Income-tax Act, 1961, as amended by the Finance Act, 2023

- Appendix

- List of provisions of Allied Acts/Circulars/Regulations referred to in Income-tax Act

- Text of provisions of Allied Acts/Circulars/Regulations referred to in Income-tax Act

- Validation Provisions

- Subject Index

- Division Two – Finance Act, 2023

- Text of the Finance Act, 2023

- Division One – Income-tax Act, 1961

- [Annotations] under each section shows:

- Relevant Rules & Forms

- Relevant Circulars & Notifications

- Date of enforcement of provisions

- Allied Laws referred to in the section

- [Legislative History of Amendments] since 1961

- Comprehensive Table of Contents

- [Quick Navigation] Relevant section numbers are printed in folios for quick navigation

- [Bestseller Series] Taxmann’s series of bestseller books for more than five decades

- [Zero Error] Follows the six-sigma approach to achieve the benchmark of ‘Zero Error’

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | VINOD K SINGHANIA |

| ISBN | 9789356226845 |

| PUBLICATION | TAXMANN PUBLICATIONS |

| YEAR OF PUBLICATION | 2023 |

Reviews

There are no reviews yet.