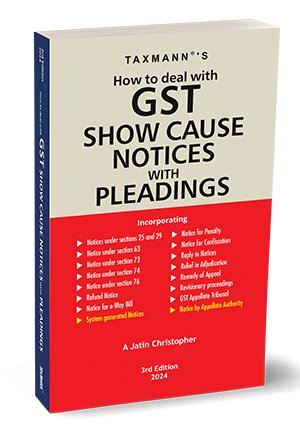

Taxmann’s How to Deal with GST Show Cause Notices with Pleadings 3rd edition 2024

Original price was: ₹1,050.00.₹840.00Current price is: ₹840.00.

This book effectively demonstrates how to deal with various types of GST Show Cause Notices. It discusses the complexities of GST Show Cause Notice and its impact on taxpayers. The book addresses the divisive stance on GST’s implementation, categorizing tax litigants into those distressed by the law’s disregard for its foundational principles and those demanding strict adherence to the statute.

With a focus on clarity and practicality, the book emphasizes using real-world examples over dense text, aiding readers in grasping the intricacies. The author showcases solutions to the mistakes committed over the years of his litigation practice. This book is divided into two divisions:

- Notices under GST

- Pleadings in GST

The Present Publication is the 3rd Edition and has been amended up to 31st December 2023. This book is authored by A Jatin Christopher, with the following noteworthy features:

- [Do’s & Don’ts while Replying to Notices] that are extensively illustrated with hypothetical facts curated to suit the GST context and expose the nuances of replying to Notices

- [Checklists, Visualizations & Templatized Answers] are included in this book to share experiences gathered in a short period since the introduction of GST

- [Suggestions for Additional Reading & Reference] are made in this book to help the reader extend their study of the subject matter

- [Simplistic Language] that revolves in & around the statutory provisions, without repeating the bare provisions of the statute

Out of stock

Additional information

| BINDING | PAPERBACK |

|---|---|

| EDITION | 3rd |

| ISBN | 9789357787970 |

| PUBLICATION | TAXMANN PUBLICATIONS |

| YEAR OF PUBLICATION | 2024 |

Reviews

There are no reviews yet.