Sale!

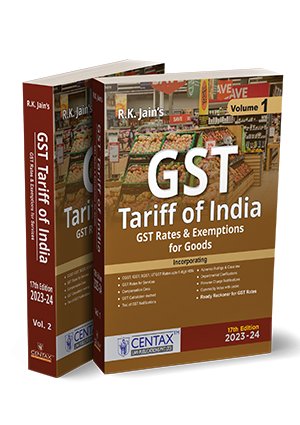

R.K. Jain’s GST Tariff of India (Set of 2 Volumes) – 17th Edition FEBRUARY 2023

Original price was: ₹3,495.00.₹2,795.00Current price is: ₹2,795.00.

Out of stock

Description

This book provides complete details about the taxability & GST rates for goods & services. It also includes a ready reckoner for GST rates, GST Notifications, Advanced Rulings & Case Laws. Lastly, it incorporates basic details, such as:

- How to use GST Tariff?

- How to Calculate Tax under GST

- Introduction to GST Tariff

- Classification of Goods & Services under GST

- Interpretative Rules, as applicable to GST Tariff

- List of Abbreviations used in the Tariff

The Present Publication is the 17th Edition and has been amended as on 1st February 2023. This book is authored by R.K. Jain and edited by CA (Dr) Arpit Haldia. It consists of nine parts.

- Part 1 – GST Tariff | Goods (GST Rates up to 8 Digits of HSN/Customs Tariff & Exemptions under CGST, SGST, UTGST & IGST)

- Rates Specified in Other Acts

- Part 2 – Notifications | GST Rates & Exemption for Goods

- CGST Rates for Goods – Schedules I to VII – Notification No. 1/2017-C.T. (Rate)

- Fully Exempted CGST Goods (Nil Rated) – Notification No. 2/2017-C.T. (Rate)

- Exemption Notifications (Miscellaneous) for Goods & Services

- Part 3 – GST Tariff | Services (Chapter 99) | Ready Reckoner for GST Rates & Exemptions for Services

- Ready Reckoner for GST Rates and Exemptions on Services under CGST, SGST, UTGST & IGST – Chapter 99 with Service Codes

- Notifications on Services under GST

- CGST Notifications on Services

- IGST Notifications on Services

- UTGST and SGST Notifications on Services

- Explanatory Notes to Scheme of Classification of Services under GST

- Circulars, Instructions, Press Notes, Case Law, Advance Rulings and FAQ on supply of Services

- FAQs on Services

- Circulars, Instructions, Press Notes & Case Law on Services

- Case Laws

- Codewise List of Services [Service Codes (Tariff) (SAC) & Scheme of Classification of Services]

- Alphabetical List of Services with Service Codes (SAC)

- Part 4 – Integrated Goods and Services Tax (IGST)

- Bird’s eye view of Integrated Goods and Services Tax (IGST)

- Notifications issued under IGST

- IGST Law and Procedures – Notifications

- IGST Rates – Notifications

- Fully Exempted IGST Goods (Nil Rated) – Notifications

- IGST Exemption Notifications

- Part 5 – GST Rates | Ready Reckoner for Goods (Ready Reckoner for GST Rates for Goods under CGST, SGST, UTGST & IGST)

- Part 6 – Compensation Cess for States & Other Cesses for Goods & Services

- Notifications issued under GST Compensation Cess

- Departmental Clarifications under Compensation Cess

- Part 7 – Reverse Charge Mechanism for Goods & Services

- Reverse Charge Mechanism for CGST – Notifications

- Reverse Charge Mechanism for IGST – Notifications

- Reverse Charge Mechanism for UTGST – Notifications

- Reverse Charge Mechanism for SGST – Notifications

- Departmental Clarifications

- Part 8 – Commodity Index with HSN Codes

- Part 9 – Chronological List of Basic Notifications

The coverage of the book is as follows:

- CGST, IGST, SGST, UTGST Rates upto 8 digit HSN

- GST Rates for Services

- Compensation Cess

- GST Calculation Method

- Text of GST Notifications

- Advance Rulings & Case Laws

- Departmental Clarifications

- Reverse Charge Notification

- Commodity Index with Codes

- Ready Reckoner for GST Rates

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | R.K JAIN |

| EDITION | 17TH |

| ISBN | 9789391055073 |

| PUBLICATION | CENTAX PUBLICATION |

| YEAR OF PUBLICATION | 2023 |

Reviews

There are no reviews yet.