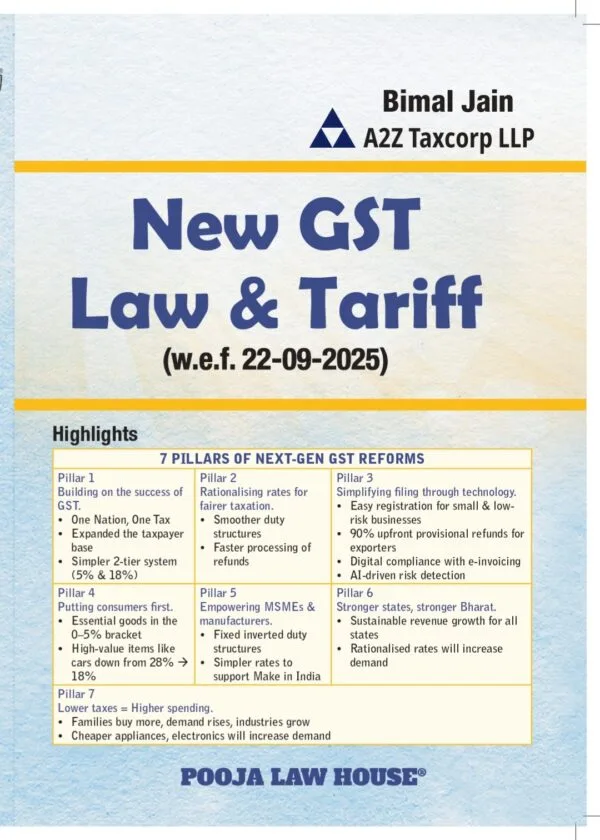

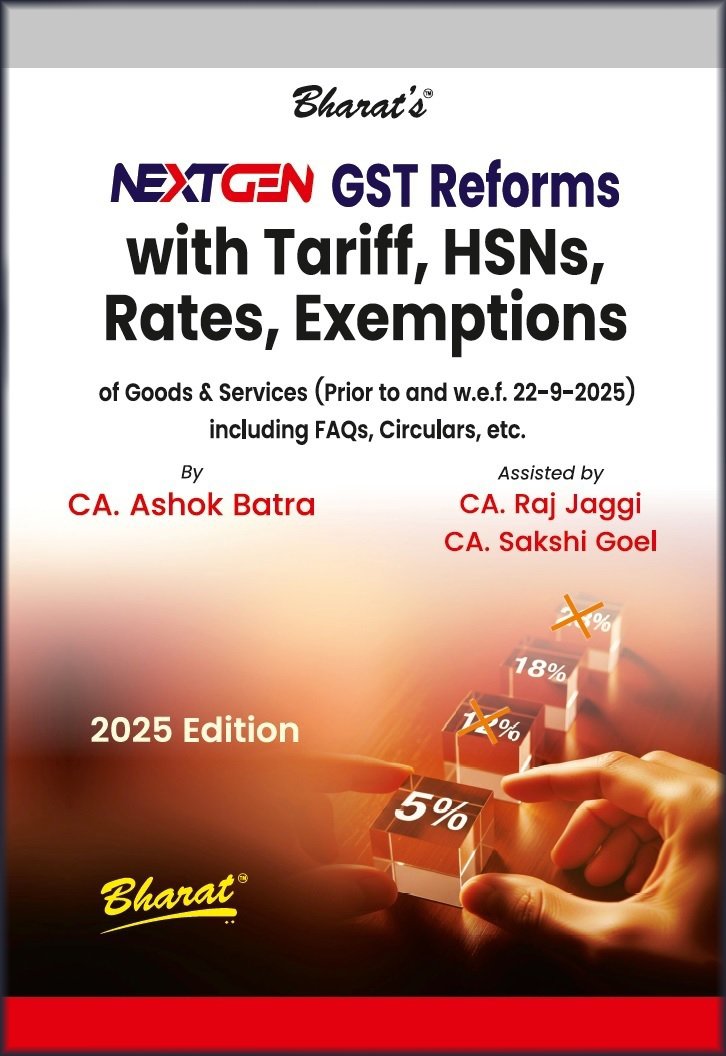

NEXTGEN GST Reforms with Tariff, HSNs, Rates, Exemptions by CA. Ashok Batra – 1st Edition 2025

Original price was: ₹2,195.00.₹1,645.00Current price is: ₹1,645.00.

NEXTGEN GST Reforms with Tariff, HSNs, Rates, Exemptions by CA. Ashok Batra – 1st Edition 2025

Description

Division 1

Referencer

Referencer 1 Definitions of various terms

Referencer 2 Updated Appeal and Revision Forms

Referencer 3 List of Latest Notifications, Circulars, FAQs, Press Releases, etc.

Referencer 4 Comparison of Schedules under Goods Rate Notifications

Referencer 5 Amended Rates of Tax on Services & ITC Eligibility (Full, Restricted, or Nil) – Effective from 22.09.2025

Division 2

Practice and Procedure

Chapter 1 Rate of Tax and Related Issues including ITC

Chapter 2 Specified Provisions of Finance Act, 2024 made applicable with effect from 01.10.2025

Chapter 3 CGST (Third Amendment) Rules, 2025

Chapter 4 Other Miscellaneous Provisions

Chapter 5 Changes recommended by GST Council but not yet Implemented

Division 3

Exempted Goods and GST Rates on Goods

Part A Exempted goods under GST Acts namely CGST Act, IGST Act and respective SGST Acts w.e.f. 22.09.2025

Part B Exempted goods under GST Acts namely CGST Act, IGST Act and respective SGST Acts from 01.07.2017 to 21.09.2025

Part C Exempted goods under IGST Act Only w.e.f. 01.07.2017 till 21.09.2025

Part D Exemption from Compensation Cess on Supply of Goods

Part E Compensation Cess rates on supply of specified goods with effect from 01.07.2017

Part F CGST Rates of Goods with HSN Codes w.e.f. 22.09.2025

Part G CGST Rates of Goods with HSN Codes w.e.f. 01.07.2017 till 21.09.2025

Division 4

Exempted Services and GST Rates on Services

Part A Exempted Services under CGST, IGST and SGST Acts w.e.f. 01.07.2017 (As amended w.e.f. 22.09.2025)

Part B Exempted services under IGST Act only w.e.f. 01.07.2017

Part C CGST rates of services with accounting codes w.e.f. 01.07.2017 (As amended w.e.f. 22.09.2025)

Part D Scheme of Classification of Services

Part E Compensation Cess Rates on Services w.e.f. 01.07.2017

Division 5

Notifications/Circulars/Orders/FAQs, etc.

Part A Central Goods and Services Tax Notifications

Part B Central Tax (Rate) Notifications

Part C Integrated Goods and Services Tax (Rate) Notifications

Part D GST Compensation Cess (Rate) Notifications

Part E Ministry of Finance Notifications Related to Appeals before GSTAT

Part F GST Circulars

Part G Circular of Ministry of Consumer Affairs, Food and Public Distribution

Part H Circular of Ministry of Finance, Department of Revenue (Tax Research Unit)

Part I Office Memorandum of Ministry of Chemicals & Fertilizers

Part J Orders of Directorate General of Health Services

Part K GST Press Releases

Part L Frequently Asked Questions (FAQs)

LIST OF ACRONYMS

| S.No. | Acronym | Full Form |

| 1. | BR | Butadiene Rubber |

| 2. | CCTV | Closed-Circuit Television |

| 3. | DMO | De-Mentholised Oil |

| 4. | DTMO | De-Terpenated Mentha Oil |

| 5. | EPDM | Ethylene-Propylene-Non- Conjugated Diene Rubber |

| 6. | FRK | Fortified Rice Kernel |

| 7. | GRG | Glass-fibre Reinforced Gypsum Board |

| 8. | IIR | Isobutene-isoprene (butyl) rubber |

| 9. | KVIC | Khadi and Village Industries Commission |

| 10. | LD Slag | Linz-Donawitz Slag |

| 11. | LED | Light-Emitting Diodes |

| 12. | LPG | Liquefied Petroleum Gases |

| 13. | NDEC | Non-Domestic Exempted Category |

| 14. | UHT Milk | Ultra-High Temperature Milk |

| 15. | Wind Operated Electricity Generator | WOEG |

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | ASHOK BATRA |

| EDITION | 2025 |

| ISBN | 9788119565078 |

| PUBLICATION | Bharat Law House Pvt. Ltd. |

Reviews

There are no reviews yet.