Sale!

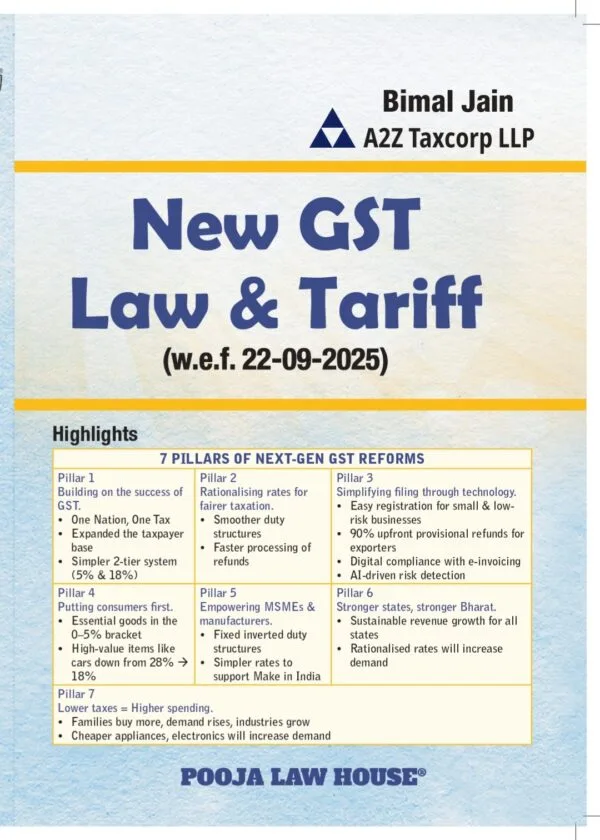

New GST Law & Tariff by Bimal Jain – Edition September 2025

Original price was: ₹1,250.00.₹899.00Current price is: ₹899.00.

New GST Law & Tariff by Bimal Jain – Edition September 2025

Description

Key Features of the Book

- Detailed commentary on CGST, SGST, IGST, UTGST, and GST Compensation Cess Laws, along with

the Rules made thereunder to encapsulate the provisions for easy digest. - Discussion on various domains – viz. supply of goods or services intra-state and interstate, principles of

place of supply & time of supply, taxable person, GST ITC, Invoice Management System (IMS), reverse

charge, exports and imports, job work, GST rates, TDS, TCS, e-way bill, appeals and revision, demand

and recovery, inspection, search, seizure, & arrest, offences, penalties, etc. - In-depth analysis of the meaning and scope of the term ‘supply’, principles of ‘time & place of supply’

with multiple case studies and likely issues with way forward suggestions. Analysis and discussion on

seamless flow of input tax credit in GST with multiple examples. - Case studies on various aspects of ‘valuation’ – transaction value, related party transactions, stock transfers,

cross charge, corporate guarantee, etc. - Analysis of Exports, Imports, and supplies to or by SEZ units/developers in GST, along with documentation

required vis-à-vis the refund mechanism. - Flowcharts on various rules & procedural aspects of GST-registration, payment, invoice, returns, and

refund, along with guidance & implementation of ‘e-invoicing’ and ‘QR Code’ - Analysis of various provisions for assessment & audit, demand & recovery, and offences & penalties,

search, seizure, arrests, and compounding of offences, along with procedural flowcharts for appeals &

revision and advance ruling. - Detailed commentary on the constitution of the GST Appellate Tribunal and Benches thereof.

- Detailed commentary on filing of Form GSTR-1, GSTR-1A, GSTR 2A, GSTR 2B, GSTR-3B, GSTR-4,

GSTR-6, GSTR-7, GSTR-8, GSTR-9/ 9C, GSTR-10 with payment of taxes. - All updated provisions and rules along with topic-wise bifurcation of all departmental clarifications,

CBIC FAQs as updated, press releases, circulars, orders, e-fliers, etc., as on date.

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | BIMAL JAIN |

| EDITION | 2025 |

| ISBN | 9788195505494 |

| PUBLICATION | Pooja law House |

Reviews

There are no reviews yet.