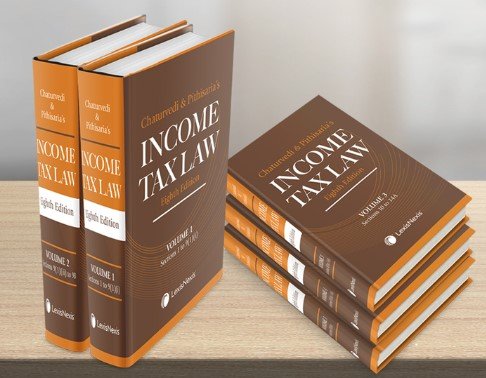

Income Tax Law by Chaturvedi and Pithisaria (Set of 5 Vols.) – 8th Edition 2024

Original price was: ₹17,475.00.₹13,800.00Current price is: ₹13,800.00.

Income Tax Law by Chaturvedi and Pithisaria (Set of 5 Vols.) – 8th Edition 2024

Out of stock

Description

This Set is in 11 vols:-

1. Volumes 1 to 5 will be released in December 2023*

2. Volumes 6 to 11 will be released in Jan 2024*

Content:-

Vol 1: Sec 1 to 9(1)(i)

Vol 2: Sec 9(1)(ii) to 9B

Vol 3: Sec 10 to 14A

Vol 4: Sec 15 to 40

Vol 5: Sec 40A to 59

This sounds like a comprehensive and authoritative resource on income tax law. Here is a summary of the key features of the eighth edition of Chaturvedi and Pithisaria’s Income Tax Law:

- Up-to-date Coverage: The book provides coverage of all legislative amendments up to the Finance Act, 2023 and the Income-tax (Twentieth Amendment) Rules, 2023, ensuring that it is current with the latest changes in tax law.

- Extensive Judicial Pronouncements: It includes more than 1,00,000 judicial pronouncements and decisions delivered by the Supreme Court of India, various High Courts in India, and select Foreign Courts, making it a valuable resource for legal professionals and authorities.

- Concise Introduction to Sections: Each chapter includes a concise and crisp introduction of the sections contained therein, along with their relevant rules, making it easier for readers to navigate and understand the content.

- Incorporation of Circulars, Notifications, etc.: The book incorporates circulars, notifications, schemes, instructions, guidelines, etc., issued by the Central Board of Direct Taxes and the Central Government through the Ministry of Finance, providing practical guidance based on official directives.

- International Taxation and Transfer Pricing: It discusses in detail almost all the concepts relating to international taxation, transfer pricing, etc., with reference to the OECD Model Tax Convention and the UN Model Tax Convention, making it relevant for international tax matters.

- Analysis of Allied Laws: The authoritative text of allied laws has been analyzed in the relevant context of the 1961 Act, along with necessary judicial pronouncements, providing a comprehensive view of the legal landscape.

- Annexures: Annexures to each chapter provide updated texts of the relevant rules of the Income Tax Rules, 1962, the relevant Articles of the Double Taxation Avoidance Agreements (DTAAs) along with judicial pronouncements, and certain relevant provisions of other allied and/or analogous laws, rules, regulations, etc., enhancing the practical utility of the book.

- Pen Drive Inclusion: The inclusion of a pen drive in Volume 11 contains commentary of omitted sections, as well as those sections which have become inoperative (but yet not omitted) for and from assessment year 2010-11, providing additional reference material for readers.

This treatise seems to be a valuable resource for professionals, tax authorities, the Judiciary, and anyone seeking a comprehensive understanding of income tax law in India.

Additional information

| BINDING | Hardcover |

|---|---|

| AUTHOR | CHATURVEDI AND PITHISARIA |

| EDITION | 2024 |

| ISBN | 9788119403455; 9788119403240; 9788119403912; 9788119403288; 9788119403325 |

| PUBLICATION | LexisNexis |

Reviews

There are no reviews yet.