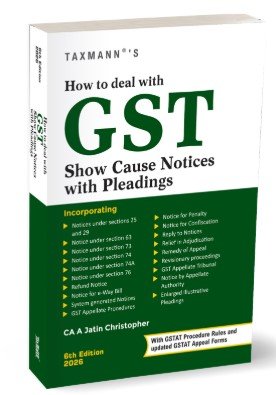

How to Deal with GST Show Cause Notices with Pleadings by Jatin Christopher – 6th Edition 2026

Original price was: ₹1,595.00.₹1,195.00Current price is: ₹1,195.00.

How to Deal with GST Show Cause Notices with Pleadings by Jatin Christopher – 6th Edition 2026

Description

How to Deal with GST Show Cause Notices with Pleadings is a litigation-first, procedure-sensitive GST practice manual that treats a show cause notice (SCN) not as a routine compliance event, but as the formal commencement of an adversarial adjudicatory process. The author’s central thesis is that the taxpayer’s earliest written position, often even before the ‘formal notice’ stage, can create irreversible evidentiary and strategic consequences, including implied admissions and constrained appellate relief. This is reinforced through sustained discussion on:

- How notices ‘set the law in motion’

- Why a reply must be a clear position against allegations (not a narrative justification)

- How does the due process under the Act–Rules–Forms architecture govern every step of demand and recovery

This Edition is particularly valuable because it integrates the post–Finance Act 2025 tribunal ecosystem—covering GSTAT procedure architecture, filing discipline, registry scrutiny, e-filing, and updated appeal forms/annexures—thereby bridging the practical gap between adjudication-stage drafting and tribunal-stage litigation readiness.

This book is designed for readers who must draft, defend, and litigate GST positions under time pressure and procedural constraints, including:

- GST Litigation Professionals (CAs/Advocates/Consultants) preparing replies, submissions, and appeal memos

- In-house Tax & Compliance Leaders managing notice risk, documentation strategy, and escalation to appeal/tribunal

- Practitioners Handling GSTAT Filings who need rule-based clarity on appeal memo design, annexures, registry scrutiny, and filing discipline

- Learners of GST Procedural Jurisprudence—burden/onus, ‘notice defects,’ limitation, service, and scope of appellate review

The Present Publication is the 6th Edition | 2026, incorporating GSTAT Procedure Rules & Updated GSTAT Appeal Forms. It is authored by CA. A Jatin Christopher with the following noteworthy features:

- [End-to-end Notice-to-tribunal Manual] The book moves from foundational concepts (due process, natural justice, cause of action, allegation vs evidence, service, limitation) into notice-specific chapters and then into appeal/tribunal mechanics, so the reader can see how early drafting choices affect later remedies

- [Practical Jurisprudence of Notices & Replies] It systematically addresses why a reply should be structured as a position (accept/discharge vs dispute/litigate), how ‘non-denial’ and vagueness can operate against a taxpayer, and how to avoid replies that accidentally expand the scope of inquiry

- [High-utility, Enlarged Illustrative Pleadings] A distinctive feature of this work is the breadth of scenario-based pleadings, covering common GST controversy patterns (2A/2B mismatches, RCM issues, debit/credit notes, exempt turnover, e-way bill mismatches, rule 86A/86B, interest/penalty-only demands, etc.)—designed to help practitioners draft with litigation consequences in mind

- [System-generated Notices & Accelerated Recovery Risk] The Edition treats system-generated notices as a separate procedural species, explaining the logic behind Rule 88C and the short-response window, and the practical reality that these notices may lead to recovery action if mishandled

- [GSTAT-ready—Procedure Rules, Filing Discipline &Appeal Memo Design] A major differentiator is tribunal preparedness. The text covers GSTAT Procedure Rules (powers, instituting appeals, registry, hearings, case management, forms/registers, records/inspection, authorised representatives, CPC interface, decisions/orders, e-filing, miscellaneous). It also emphasises appeal memo discipline, why bulky, irrelevant annexures are counterproductive and how the registry may require removal of non-essential material

The coverage of the book is as follows:

- GST Notices and Adjudication Framework

- The book begins by grounding the reader in procedures established by law, addressing concepts such as due process, natural justice, cause of action, service of notice, limitation, and the distinction between allegation and evidence. It then proceeds to a section-wise examination of GST notices, explaining:

- How registration-related notices under sections 25 and 29 operate and must be contested

- The scope and limits of best judgment assessment under section 63

- The architecture of sections 73 and 74, including pre-notice consultation, statements of demand, penalty exposure, and service requirements

- The implications of section 74A in the evolving GST enforcement framework

- Specialised notice categories such as refund notices, e-way bill notices, penalty and confiscation proceedings, and system-generated notices

- Particular emphasis is placed on system-generated notices, where compressed timelines and automated assumptions can quickly escalate into recovery proceedings if mishandled

- The book begins by grounding the reader in procedures established by law, addressing concepts such as due process, natural justice, cause of action, service of notice, limitation, and the distinction between allegation and evidence. It then proceeds to a section-wise examination of GST notices, explaining:

- Replies, Pleadings, and Evidentiary Strategy

- A core contribution of this work lies in its treatment of replies as pleadings. The author explains why pleading ‘not guilty’ is the essential first step in adjudication, and how failure to clearly deny allegations can collapse the dispute into a mere verification exercise. The book systematically demonstrates:

- When to accept and discharge a demand

- When to dispute and litigate, and how to do so without implied admissions

- How the burden initially rests on the Revenue and how the onus shifts during proceedings

- Why are excessive explanations, assertions of innocence, or pleas for leniency strategically damaging

- The enlarged illustrative pleadings serve as reference material to demonstrate disciplined drafting across common GST controversy patterns

- A core contribution of this work lies in its treatment of replies as pleadings. The author explains why pleading ‘not guilty’ is the essential first step in adjudication, and how failure to clearly deny allegations can collapse the dispute into a mere verification exercise. The book systematically demonstrates:

- Appeals, Revision, and Tribunal Practice

- The appellate chapters dismantle common misconceptions, particularly the belief that an appeal automatically opens all prior stages ‘at large’. Through precise analysis, the book explains:

- The limited contours of appellate review, including appeals against specific orders (such as rejection orders)

- The distinction between adjudicating authority and appellate authority, and why the latter is not a higher adjudicator

- The exposure of appellate orders to revisionary proceedings, and the implications of statutory carve-outs

- A significant portion of this Edition is devoted to the GST Appellate Tribunal, covering:

- GSTAT Procedure Rules 2025

- Filing mechanics, appeal forms, and annexures

- Procedural discipline, registry scrutiny, and hearing processes

- Tribunal-oriented pleadings and litigation readiness

- The appellate chapters dismantle common misconceptions, particularly the belief that an appeal automatically opens all prior stages ‘at large’. Through precise analysis, the book explains:

The book follows the natural lifecycle of a GST dispute:

- Conceptual Foundations – Notice, reply, adjudication, and due process

- Section-wise Notice Analysis – Strategy, pitfalls, and procedural safeguards

- Pleadings and Replies – Drafting discipline and illustrative pleadings

- Adjudication Outcomes and Relief

- Appeals and Revisionary Proceedings

- GST Appellate Tribunal Procedures and Pleadings

- This structure ensures that the reader not only understands individual provisions but also how early drafting choices reverberate through appeal and tribunal stages

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | A JATIN CHRISTOPHER |

| EDITION | 2026 |

| ISBN | 9789371268219 |

| PUBLICATION | TAXMANN PUBLICATIONS |

Reviews

There are no reviews yet.