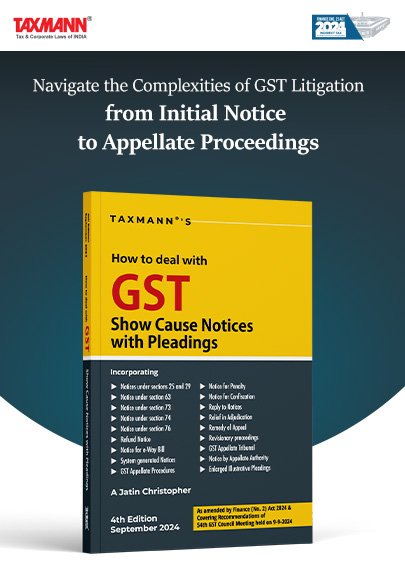

How to Deal with GST Show Cause Notices with Pleadings by A Jatin Christopher – 4th Edition 2024

Original price was: ₹1,495.00.₹1,195.00Current price is: ₹1,195.00.

How to Deal with GST Show Cause Notices with Pleadings by A Jatin Christopher – 4th Edition 2024

Description

This book is a detailed and structured guide for effectively responding to GST show cause notices. It provides a practical approach to drafting replies, providing detailed checklists, visualisations, and over 50 real-life draft pleadings. It covers various types of notices, including system-generated and sequel notices, and offers strategic guidance to mitigate aggressive demands from tax authorities.

By focusing on the clarity and practicality of legal provisions, the book helps readers understand the nuances of statutory interpretation and the impact of appellate and revisionary proceedings on GST cases. Additionally, the increasing role of data analytics in GST notices is discussed, along with strategies to expose inaccuracies and challenge unjustified demands.

This book is helpful for taxpayers, tax professionals, and legal practitioners involved in GST litigation. It provides practical guidance on replying to GST show cause notices, drafting pleadings, and navigating appellate proceedings.

The Present Publication is the 4th Edition and has been amended by the Finance (No. 2) Act 2024. It covers the recommendations of the 54th GST Council Meeting held on 9th September 2024 and is authored by A Jatin Christopher, with the following noteworthy features:

- [Comprehensive Deliberation on GST Notices] The book explains different types of notices issued under GST, including system-generated and sequel notices. It emphasises the importance of understanding the legal framework behind these notices and provides readers with structured approaches to replying, focusing on accuracy and strategic intent

- [Practical Tools for Drafting Responses] It includes practical checklists, flowcharts, and templated answers, providing tools to draft effective responses. These resources are derived from the author’s litigation experience, presenting a clear and efficient roadmap for defending against unjust demands

- [Draft Pleadings on Real-Life Issues] With over 50 real-life examples of draft pleadings, the book covers a wide range of scenarios, from pre-notice scrutiny to post-notice demands. These examples provide alternate responses, helping readers understand the stages of GST litigation more effectively

- [Do’s & Don’ts for Replying to Notices] The book provides extensive illustrations and hypothetical case studies that guide readers through best practices for replying to GST notices. Concepts like the burden of proof, admissibility of evidence, and strategic use of information are thoroughly analysed, helping readers avoid common pitfalls

- [System-Generated Notices & Swift Responses] A dedicated chapter addresses system-generated notices on the GST Common Portal and explains the swift responses required to prevent aggressive action. The author highlights how taxpayers can adopt timely and strategic approaches to mitigate risks from these automated notices

- [Jurisprudence and Statutory Interpretation] The book discusses the key jurisprudential principles, drawing parallels between tax law and contract law in terms of statutory interpretation. This section is valuable for readers who wish to understand the foundational legal concepts influencing GST litigation

- [Remediation Measures under Sections 11A and 128A] The author analyses the key remediation measures under Sections 11A and 128A, including concepts such as ‘accord’ and ‘forfeiture’. These are crucial for rectifying compliance errors and understanding how these provisions can resolve ongoing disputes

- [Strategic Approach to Drafting Pleadings] The book emphasises the strategic importance of crafting pleadings that expose misstatements and inaccuracies in GST notices. Using illustrative examples, it demonstrates how to draft responses that protect the taxpayer’s interests without prematurely revealing defences, ensuring a strong foundation for future litigation

- [Expanded Guidance on Revisionary Proceedings] Essential analysis of revisionary proceedings explains how they can affect taxpayer interests. By understanding the exceptional jurisdiction in these cases, readers can refine their replies to notices, ensuring no unintended consequences

- [The Role of Data Analytics in GST Notices] The book highlights the growing reliance on data analytics in issuing GST notices and how this information is often mistaken for facts. The author provides strategies for exposing flaws in data-driven notices, helping taxpayers challenge these demands more effectively

- [Practical Impact of the Finance (No. 2) Act, 2024] The book examines the amendments introduced by the Finance (No. 2) Act, 2024, including the implications of Section 74A for notice issuance. It discusses how these changes affect taxpayers’ rights and procedural safeguards

The structure of the book is as follows:

- Division One | Notices under GST – This section explains the statutory provisions governing GST notices, giving readers a clear understanding of how and why notices are issued, the role of appellate authorities, and the optimal strategies for replying

- Division Two | Pleadings in GST – This section provides practical guidance on drafting pleadings, providing over 50 real-life examples of responses to GST notices. These drafts are applicable across various stages of litigation, from pre-notice inquiries to appellate hearings

The chapter breakdown of the book is as follows:

- Chapter 1 | Background

- This chapter introduces the essential legal foundations of GST notices, including procedures, principles of natural justice, and the importance of evidence and due process in GST disputes. It also discusses the implications of GSTN data and vagueness in denial

- Chapters 2 to 3 | Notices Under Sections 25, 29, and 63

- These chapters address notices issued under GST Sections 25, 29, and 63, focusing on the anatomy of these notices, limitations of scope, and options for taxpayers regarding suspension, cancellation, or provisional assessments. It also covers how to manage jurisdictional challenges and best judgment assessments

- Chapters 4 to 6 | Notices Under Sections 73, 74, and 74A

- These chapters outline notices under Sections 73, 74, and 74A, explaining the demand and recovery process, penalties, pre-notice consultations, and the specific conditions under each section. It also provides insights into the new limitations introduced by Section 74A

- Chapters 7 to 10 | System-Generated Notices, Refunds, and E-Way Bills

- These chapters discuss notices under Section 76, system-generated notices, notices related to refunds, and those concerning E-Way Bills. They cover procedural and compliance concerns, automated notices, and options for responding to discrepancies

- Chapters 11 to 12 | Penalty and Confiscation Notices

- These chapters explain the statutory and procedural aspects of penalty and confiscation notices, focusing on infraction definitions, personal penalties, seizure procedures, and relief options

- Chapters 13 to 17 | Reply Preparation and Adjudication

- These chapters outline how taxpayers should prepare replies to notices, scrutinise allegations, and engage with the adjudication process. Topics include personal hearings, cross-examinations, and remedies from adjudication orders.

- Chapters 18 to 20 | Appeals and Relief in Appeal

- These chapters address the appeal process, providing detailed steps on how appeals should be structured before Appellate Authorities and Tribunals. It also covers the limits of appellate powers and the scope of relief that can be sought

- Chapters 21 to 24 | Tribunal Procedures and Jurisprudence

- These chapters describe revisionary proceedings and tribunal procedures, including the scope of tribunal powers, the applicability of case law, and the precedents that govern GST-related disputes.

- Chapters 25 to 27 | Pleadings for Replies, Departmental Engagement, and Appeal Memo

- These chapters cover various pleadings, from responding to notices, engaging with departmental authorities and drafting appeal memos. They include examples of common issues like mismatches in GSTR filings and RCM liabilities

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | A JATIN CHRISTOPHER |

| EDITION | 2024 |

| ISBN | 9789364555814 |

| PUBLICATION | TAXMANN PUBLICATIONS |

Reviews

There are no reviews yet.