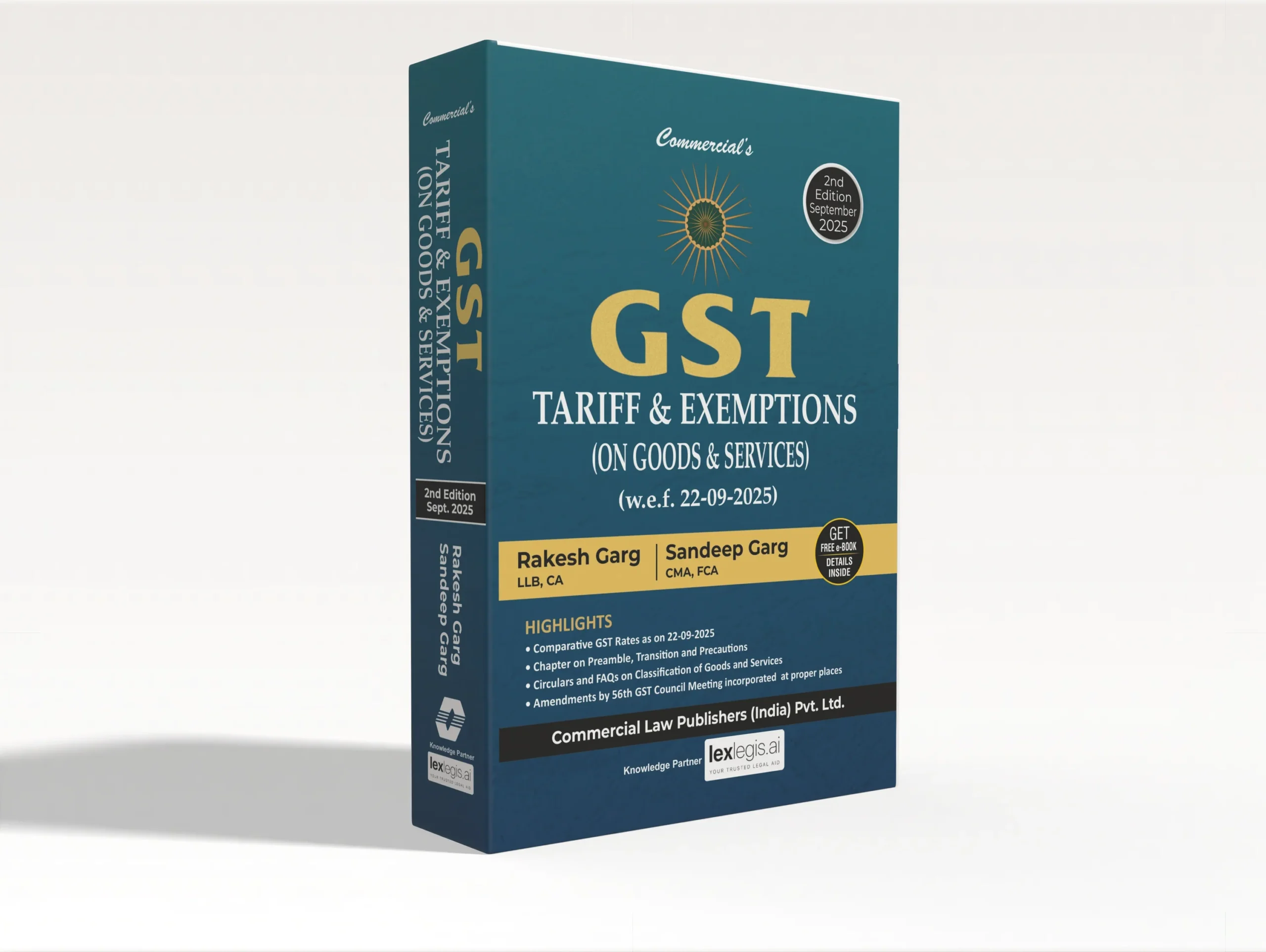

GST Tariff and Exemptions (on Goods & Services) by Rakesh Garg & Sandeep Garg – 2nd Edition 2025

Original price was: ₹2,495.00.₹1,875.00Current price is: ₹1,875.00.

GST Tariff and Exemptions (on Goods & Services) by Rakesh Garg & Sandeep Garg – 2nd Edition 2025

Description

This 2025 Edition of GST Tariff & Exemptions (On Goods & Services) provides a comprehensive and practical reference on the applicable GST rates and exemption entries for goods and services across sectors, updated w.e.f. 22-09-2025 and incorporating amendments arising from the 56th GST Council Meeting.

The book offers an HSN/SAC-wise presentation of tariff classifications, rate slabs, and exemption notifications with conditions, explanations, and effective dates. Comparative tables and editorial notes highlight recent changes, common classification pitfalls, and documentation requirements, making it a ready reckoner for accurate charging of tax, eligibility of exemptions, and compliant invoicing.

Key highlights include:

• HSN- and SAC-wise schedules of GST rates with clear item descriptions and notes on inclusions/exclusions

• Comparative rate tables showing pre- and post-22-09-2025 changes for quick impact assessment

• Consolidated exemption entries with conditions, provisos, explanations, and linked notifications

• Coverage of nil-rated, exempt, non-GST, and zero-rated supplies with practical applicability notes

• Chapter on Preamble, Transition, and Precautions to implement rate/exemption changes smoothly

• Circulars and FAQs on classification of goods and services curated at the relevant entries

• Indicators for reverse charge and other special taxability flags where applicable

• Ready references for documentation, declarations, and records required to substantiate exemptions

• Handy cross-references between allied entries, chapter/section notes, and related notifications

• Practical tips to avoid common misclassification errors and disputes during audit/scrutiny

This edition is invaluable for:

• Chartered accountants, GST practitioners, and consultants handling classification and rate queries

• In-house tax and finance teams responsible for pricing, invoicing, and compliance

• Indirect tax officers and advisors engaged in scrutiny, audit, and adjudication

• Students and academicians seeking a concise, reliable compendium of GST rates and exemptions

By combining statutory rate schedules, exemption provisions, official clarifications, and practical guidance, this book serves as an authoritative guide to GST tariff classification and exemption eligibility in India.

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | Rakesh Garg & Sandeep Garg |

| EDITION | 2025 |

| ISBN | 9789349957916 |

| PUBLICATION | Commercial Law Publishers (India) Pvt. Ltd. |

Reviews

There are no reviews yet.