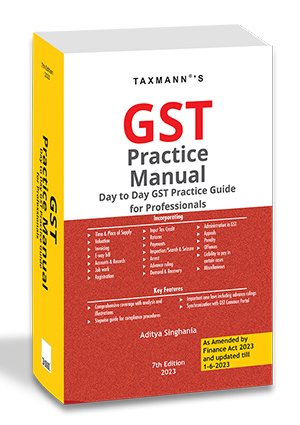

Taxmann GST Practice Manual by Aditya Singhania – 7th Edition 2023

Original price was: ₹3,995.00.₹2,975.00Current price is: ₹2,975.00.

GST Practice Manual by Aditya Singhania – 7th Edition 2023

Out of stock

Description

This book is a comprehensive guide for day-to-day compliance with GST. It helps you understand the following topics related to GST:

- Background

- Concepts

- Execution

- Challenges

- Solution(s)

It also explains the provisions of the GST law lucidly. This book will be helpful for GST Professionals engaged in managing the client’s day-to-day GST-related affairs, i.e., advisory, compliance and litigation services.

The Present Publication is the 7th Edition, amended by the Finance Act 2023 and updated till 1st June 2023. This book is authored by Aditya Singhania with the following noteworthy features:

- [Comprehensive Coverage] with detailed analysis and relevant illustrations

- [Stepwise Guide] for GST compliance procedures

- [Judicial Outlook] of GST Case Laws (including Advance Rulings)

- [GST Common Portal] The content in this book is synchronized with the current features available at GST common portal

- [Topic-Wise Explanation] along with related GST Notifications and Circulars

- [Practical Issues] with solutions

The contents of the book are as follows:

- Time/Place of Supply & Valuation

- Time of Supply

- Place of Supply

- Valuation

- Accounting in GST

- Invoicing

- Accounts & Records

- E-Way Bill

- Job-Work

- Registration

- Basics of Registration

- Compulsory Registration

- Person not Liable to take Registration & Voluntary Registration

- General Procedure of Registration

- Amendment of Registration

- Cancellation or Suspension of Registration

- Revocation of Registration

- Specified Taxable Person

- Non-Resident Taxable Person

- OIDAR

- Unique Identification Number (UIN)

- Composition Scheme

- Basics of Composition Scheme

- Compliances under the Composition Scheme

- Withdrawal from the Composition Scheme

- Returns under the Composition Scheme

- Input Tax Credit (including ISD)

- Eligibility of Input Tax Credit

- Apportionment of Input Tax Credit

- Availability of ITC in certain circumstances

- ITC for Job Worker

- Compliance for Input Service Distributor

- Returns for an Input Service Distributor

- Returns

- Introduction to GST Returns

- GSTR 1

- GSTR 2, 2A and 2B

- GSTR 3

- GSTR 3B

- Matching Concept

- Proposed new GST Return

- Annual Return for Normal Taxpayer

- Annual Return for Composition Taxpayer

- Final Return

- Audit

- Departmental Audit

- GST Audit

- TDS & TCS

- Tax Deducted at Source

- Tax Collection at Source

- Payment

- Basics of Payment

- Treatment of Input Tax Credit for Payment

- Treatment of Electronic Cash/Credit Ledger

- Treatment of Electronic Liability Ledger

- Miscellaneous on Payments

- Refunds

- Basics of Refunds

- Refund Procedures

- Assessment

- Self & Provisional Assessment

- Scrutiny of Returns

- Assessment of Non-Filers of Returns

- Assessment of Unregistered Persons

- Summary Assessment

- Finalization of Provisional Assessments, Appeal

- Search and Seizure

- Inspection, Search and Seizure

- Arrest

- Advance Rulings

- Basics of Advance Ruling

- Application and Compliances for Advance Rulings

- Appellate Authority for Advance Ruling

- Demand & Recovery

- Administration in GST

- Demand

- Recovery

- Appeals

- Appeals to Appellate Authority

- Appeals to Appellate Tribunal

- Appeals to High Courts & Supreme Court

- Miscellaneous on Appeals

- Offences

- Penalty

- Detention, Seizure and Release of Goods and Conveyances in Transit

- Confiscation of Goods or Conveyances

- Miscellaneous Topics under Offences

- Compounding of Offences

- Miscellaneous

- Corporate Debtor under Insolvency and Bankruptcy Code, 2016

- Liability to Pay in Certain Cases

- Repeal and Saving

Additional information

| AUTHOR | Aditya Singhania |

|---|---|

| BINDING | PAPERBACK |

| EDITION | 2023 |

| PUBLICATION | TAXMANN PUBLICATIONS |

Reviews

There are no reviews yet.