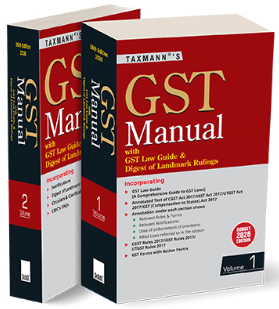

GST Manual with GST Law Guide & Digest of Landmark Rulings By Taxmann (Set of 2 Vols.) – 26th Edition 2026

Original price was: ₹4,895.00.₹3,675.00Current price is: ₹3,675.00.

GST Manual with GST Law Guide & Digest of Landmark Rulings By Taxmann (Set of 2 Vols.) – 26th Edition 2026

Description

GST Manual with GST Law Guide & Digest of Landmark Rulings is Taxmann’s most comprehensive, practice-oriented, and execution-ready reference on India’s Goods and Services Tax law. Presented as a two-volume integrated system, the Manual is editorially designed to function as a complete GST operating framework—covering legislative intent, statutory text, delegated legislation, procedural execution, departmental interpretation, and binding judicial precedent in a single, coherent structure. This Manual captures GST law as it actually operates in force, after incorporating Finance Act amendments, post-Budget notifications, rule changes, circulars, FAQs, and landmark judicial developments. The publication enables users to understand not only what the law says, but also how it is enforced, complied with, interpreted, and litigated across the GST lifecycle.

This publication is intended for advanced professional and institutional users who require depth, accuracy, and defensibility in GST matters, including:

- Chartered Accountants, Cost Accountants, and Company Secretaries engaged in GST compliance, advisory, audit, and representation

- Tax Advocates and Litigation Counsel handling assessments, adjudication, appeals, and writs

- Corporate Tax, Finance, and Legal Teams managing multi-state GST compliance and risk

- GST Practitioners and Consultants advising on classification, valuation, ITC, refunds, audits, and investigations

- Departmental Officers and Quasi-Judicial Authorities requiring a consolidated statutory and interpretative reference

- Academicians and Advanced Students specialising in indirect tax law

The Present Publication is the 26th Edition, updated till 1st February 2026. This book is edited by Taxmann’s Editorial Board, with the following noteworthy features:

- [Two-volume Integrated GST Law System] Seamless integration of substantive law, delegated legislation, procedure, interpretation, and jurisprudence

- [Budget 2026 ‘Change-First’ Architecture] Finance Bill 2026 extracts, Notes on Clauses, Explanatory Memorandum, and TRU letter to explain what changed and why

- [GST Law Guide Included] A comprehensive thematic guide explaining GST concepts, principles, and operational treatment

- [Fully Annotated GST Acts] CGST, IGST, UTGST, and GST Compensation to States Act with granular section-wise annotations

- [Section-Level Traceability] Each provision is mapped with relevant Rules, Forms, Notifications, enforcement dates, and allied laws

- [Comprehensive Rules & Forms Coverage] Including procedural, cess, UT-specific, and tribunal-related rules

- [Forms with Action Points] Practical execution guidance linking forms to rules, timelines, and compliance consequences

- [Exhaustive Notifications Repository] Covering CGST, IGST, UTGST, rate and allied notifications

- [Digest of Landmark Rulings] Supreme Court and High Court decisions with section-wise and alphabetical keys

- [Departmental Interpretation Layer] Consolidated Circulars, Clarifications, and CBIC FAQs

- [Constitutional Context Included] GST’s constitutional foundation under the 101st Constitutional Amendment

The Manual spans statutory law, procedural rules, departmental clarifications, and judicial interpretations:

- Volume 1 | Core Law, Conceptual Framework & Enforcement – Volume 1 forms the statutory and procedural backbone of the GST ecosystem

- It opens with a Budget 2026 ‘change-first’ section, presenting relevant extracts of the Finance Bill, Notes on Clauses, Explanatory Memorandum, and the TRU letter. This allows users to first understand legislative intent, amendment rationale, and implementation mechanics, before engaging with the consolidated law

- The GST Law Guide that follows offers a structured, thematic explanation of GST across its full lifecycle. It covers, inter alia, taxable event, valuation, input tax credit, place of supply (domestic and cross-border), exports and imports, time of supply, reverse charge, exemptions, concessions to small enterprises, invoicing, e-way bill, payment, returns, assessment and audit, demand and recovery, refunds, offences and penalties, appeals and revision, prosecution and compounding, e-commerce, miscellaneous issues, and the constitutional background of GST. This guide serves as the conceptual lens through which the statutory provisions are intended to be read

- The volume then presents the annotated text of the principal GST Acts:

- Central Goods and Services Tax Act 2017

- Integrated Goods and Services Tax Act 2017

- Union Territory Goods and Services Tax Act 2017

- Goods and Services Tax (Compensation to States) Act 2017

- Each Act is supported by:

- Arrangement of Sections for navigation

- Full statutory text

- Removal of Difficulties Orders, where applicable

- Relevant notifications enforcing provisions and amendments

- Validation provisions

- Subject indexes

- Crucially, annotations under each section indicate relevant Rules, Forms, Notifications, dates of enforcement, and references to allied laws—transforming the Bare Act into a working statute without compromising legislative purity

- Volume 1 further consolidates the GST Rules and procedural framework, including CGST Rules, IGST Rules, UTGST Rules, Compensation Cess Rules, settlement of funds rules, UT-specific rules, and tribunal-related procedural and service rules

- The GST Forms are presented with Action Points, converting statutory forms into practical execution tools by clarifying purpose, governing rule, timelines, and next steps—making the volume particularly effective for day-to-day compliance, audits, and departmental proceedings

- Volume 2 – Notifications, Jurisprudence & Departmental Interpretation – Volume 2 functions as the interpretative, administrative, and litigation layer of the GST framework

- It contains an exhaustive and systematically organised compilation of:

- Notifications issued under CGST, IGST, and UTGST laws, including rate, exemption, procedural, and administrative notifications

- Digest of Landmark Rulings, covering Supreme Court and High Court decisions that shape GST interpretation, supported by:

- Section-wise keys for statute-driven research

- Alphabetical keys for issue- and topic-based access

- Circulars and Clarifications issued by CBIC, reflecting official departmental positions on contentious and practical issues

- CBIC FAQs, providing authoritative explanatory guidance across sectors and compliance areas

- The volume also includes constitutional provisions, notably the Constitution (One Hundred and First Amendment) Act 2016, along with relevant constitutional articles and enforcement dates—placing GST within its federal and constitutional framework

- It contains an exhaustive and systematically organised compilation of:

The Manual follows a layered, decision-oriented editorial architecture:

- Change & Intent Layer – Budget 2026 amendments with legislative rationale

- Conceptual Layer – GST Law Guide explaining principles and operational logic

- Primary Law Layer – Clean, authoritative statutory text of GST Acts

- Delegated Legislation Layer – Rules, Forms, and Notifications linked to enabling sections

- Execution Layer – Forms with Action Points for compliance and procedural certainty

- Interpretation & Litigation Layer – Circulars, FAQs, and landmark judicial rulings

- This structure allows the user to move seamlessly from law → procedure → interpretation → litigation strategy, all within a single reference set

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | Taxmann's Editorial Board |

| EDITION | 2026 |

| ISBN | 9789375610304 |

| PUBLICATION | TAXMANN PUBLICATIONS |

Reviews

There are no reviews yet.