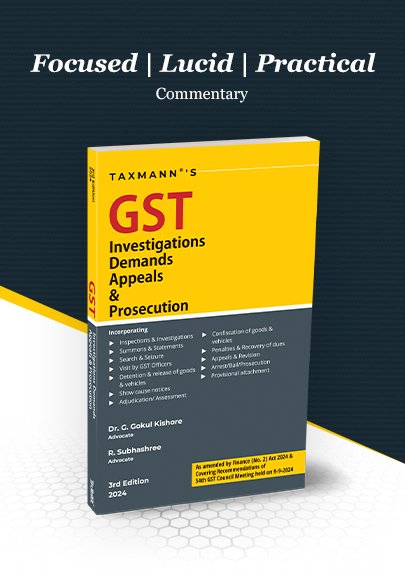

GST Investigations Demands Appeals & Prosecution by G. Gokul Kishore, R. Subhashree – 3rd Edition 2024

Original price was: ₹1,295.00.₹970.00Current price is: ₹970.00.

GST Investigations Demands Appeals & Prosecution by G. Gokul Kishore, R. Subhashree – 3rd Edition 2024

Out of stock

Description

This book addresses the growing jurisprudence under GST law, which mirrors many principles and legal precedents from pre-GST laws. It consolidates statutory provisions, departmental instructions, and emerging legal commentary on key issues like inspection, search, summons, seizure, detention, audit, appeals, and recovery of dues.

This book will be helpful for taxpayers, departmental officers, members of the bar & bench, professionals and the judiciary to appreciate the intricate points and issues arising from the implementation of the relevant provisions conferring wide powers on the officers.

The Present Publication is the 3rd Edition, amended by the Finance (No. 2) Act, 2024. It covers the recommendations of the 54th GST Council Meeting and is authored by Dr G. Gokul Kishore & R. Subhashree, with the following noteworthy features:

- [Comprehensive Jurisprudence & Legal Framework] The book analyses statutory provisions governing GST investigations, including inspection, search, seizure, provisional attachment, arrest, and prosecution. It includes extensive jurisprudence, covering landmark judgments and orders from various High Courts, and offers a comprehensive understanding of how pre-GST principles continue to shape current GST matters

- [Detailed Statutory Commentary] Step-by-step commentary is provided on statutory provisions under GST law, guiding readers through the legal processes of exercising tax officers’ powers and the corresponding rights of taxpayers. The key procedures, such as search and seizure, issuance of show cause notices, adjudication, and appeals, are thoroughly explained with references to relevant judgments and departmental instructions

- [In-Depth Appeals & Revisions Process] The book elucidates the entire GST adjudication process, from issuing show-cause notices to appeals and revisions. It highlights the practical implications of the absence of a GST Appellate Tribunal, detailing how taxpayers seek relief through High Courts, with clear guidance on navigating each stage

- [Practical Insights for Stakeholders] Taxpayers, legal professionals, and tax officers benefit from real-world insights on handling disputes, compliance issues, inspections, audits, appeals, and recovery actions. The commentary is complemented by practical advice, making the content accessible for both compliance and litigation contexts

- [Comprehensive Appendices & Procedural Guidelines] An extensive set of appendices provides departmental guidelines, instructions on detention, provisional attachments, and SOPs issued by state governments. These appendices serve as standardised references for practitioners, providing clear procedural insights on enforcement actions under GST

The structure of the book is as follows:

- Introduction

- This chapter sets the foundation by discussing the quasi-judicial and police powers granted to tax authorities under GST and the safeguards available to taxpayers. It reflects on how pre-GST jurisprudence impacts the interpretation of current GST provisions

- Inspection, Search, and Seizure

- This chapter provides a comprehensive commentary on Section 67 of the CGST Act, detailing the powers of tax authorities for inspection, search, and seizure. It includes departmental instructions, frequently asked questions (FAQs), and important High Court rulings, guiding both tax officers and taxpayers in understanding these procedures

- Summons & Document Production

- This chapter explores the process of issuing summons to individuals, company directors, and employees for providing statements and documents during investigations. The chapter also discusses the scope of these powers, the rights of taxpayers, and the responsibilities of tax officers

- Audit & Access to Business Premises

- This chapter discusses the statutory provisions for audits under GST, including the rights of tax officers to access business premises and the compliance obligations for taxpayers. It provides practical guidance on understanding the audit process effectively

- Detention, Seizure & Release of Goods in Transit

- This chapter focuses on the powers of tax officers to detain goods and conveyances during transit. It discusses the legal provisions and remedies available for the release of detained or seized goods and vehicles and includes references to significant judgments

- Demands & Adjudication

- This chapter examines the issuing of show-cause notices, demands for unpaid taxes, and subsequent adjudication proceedings. It emphasises the principles of natural justice and discusses landmark judgments on the clarity and legality of notices and orders passed without hearings

- Confiscation of Goods & Penalties

- This chapter covers the statutory provisions for confiscating goods and conveyances and imposing penalties for various GST offences. The chapter provides detailed commentary on the conditions warranting such actions, supported by case laws

- Appeals & Revisions

- This chapter guides readers through the GST appeal process, from the first appellate authority to the GST Appellate Tribunal, High Courts, and the Supreme Court. It highlights the practical issues arising from the absence of the GST Appellate Tribunal and how taxpayers seek judicial relief through alternate routes

- Arrest, Bail & Prosecution

- This chapter examines the GST provisions related to the arrest, bail, and prosecution, especially for serious offences like tax evasion and fraudulent ITC claims. It analyses legal standards for arrest, the accused’s rights, bail processes, and the compounding of offences, referencing key judicial precedents

- Provisional Attachment & Recovery of Dues

- This chapter discusses the procedure for the provisional attachment of property (including bank accounts) to secure tax dues and the framework for recovering such dues under GST law. The chapter also covers conditions for lifting attachments and includes guidelines from the Central Board of Indirect Taxes and Customs (CBIC)

- Burden of Proof & Procedures

- This chapter addresses the burden of proof in cases involving tax evasion and ITC claims, covering relevant procedural rules, legal presumptions related to documents and evidence, and insights into how courts approach these cases

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | G. Gokul Kishore, R. Subhashree |

| EDITION | 2024 |

| ISBN | 9789364557665 |

| PUBLICATION | TAXMANN PUBLICATIONS |

Reviews

There are no reviews yet.