Sale!

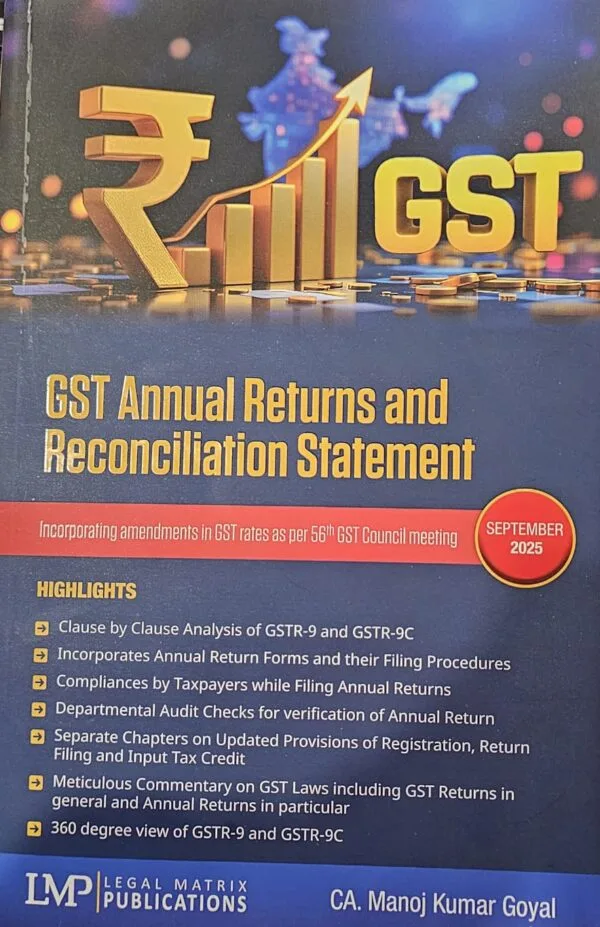

GST Annual Returns and Reconciliation Statement By CA Manoj Kumar Goyal – 1st Edition Sep 2025

Original price was: ₹2,595.00.₹1,945.00Current price is: ₹1,945.00.

GST Annual Returns and Reconciliation Statement By CA Manoj Kumar Goyal – 1st Edition Sep 2025

Description

Contents

- Basic Concepts

- Time, place and Value of Supply

- Registration – Requirements & Compliances

- Levy and Exemption from Tax

- Invoicing & Debit/Credit Notes

- Returns

- Payment of Tax

- Input Tax Credits

- Refunds

- Maintenance of accounts & Period of retention

- Assessment

- Audit

- Demands and Recoveries

- Inspection search, seizure and arrest

- Offences and penalties

- Liability to pay in Certain cases

- Miscellaneous Provision

- The IGST Act, 2017

- Introduction to Annual Returns

- Annual Return Forms

- Role of Assessees and professionals in Filling Annual Return

- 360 Degree Analysis of Annual Return ( GSTR-9 )

- 360-Degree Analysis of GSTR-9C

- Steps in Filling of GSTR-9

- Steps in Filling of GSTR-9C

- Precautions for Taxpayers While Filling GSTR-9

- Departmental Audit Checklist for GSTR-9

- Compliance by “ Taxpayer” While Preparing & Submitting GSTR-9C

- Departmental Audit Checks for Verification of GSTR-9C

- Checklist for Annual returns for professionals

- FAQ”s on from GSTR-9

- FAQ”s on from GSTR-9C

- GST Advisory

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | CA Manoj Kumar Goyal |

| EDITION | 2025 |

| ISBN | 9788199113015 |

| PUBLICATION | LMP LEGAL MATRIX PUBLICATIONS |

Reviews

There are no reviews yet.