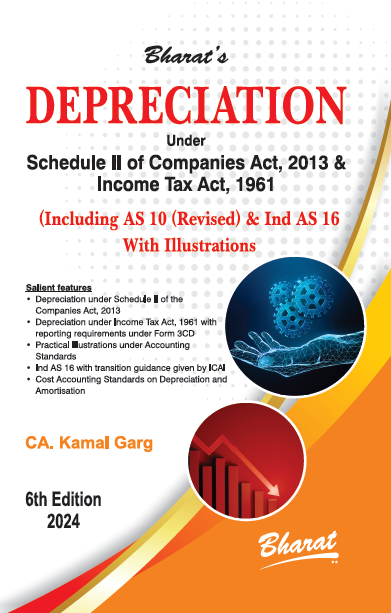

Depreciation under Schedule II of Companies Act, 2013 & Income Tax Act, 1961 by CA Kamal Garg – 6th Edition 2024

Original price was: ₹1,395.00.₹1,050.00Current price is: ₹1,050.00.

Depreciation under Schedule II of Companies Act, 2013 & Income Tax Act, 1961 by CA Kamal Garg – 6th Edition 2024

Description

Chapter 1 Depreciation under Companies Act, 2013

Chapter 2 AS-6 (Revised): Depreciation Accounting

Chapter 3 AS-10: Accounting for Fixed Assets

Chapter 4 AS-10: Property, Plant and Equipment

Chapter 5 Indian Accounting Standards (Ind AS 16): Property, Plant and Equipment

Chapter 6 AS-19: Leases

Chapter 7 Ind AS 116 (IFRS 16): Leases

Chapter 8 AS-26: Intangible Assets

Chapter 9 Indian Accounting Standards (Ind AS) 38: Intangible Assets

Chapter 10 AS-28: Impairment of Assets

Chapter 11 Indian Accounting Standards (Ind AS 36): Impairment of Assets

Chapter 12 Practical Illustrations on Depreciation including Transitional Provisions as per Pre-Revised AS 6 and AS 10

Chapter 13 Practical Illustrations on Depreciation as per AS 10 (Revised)

Chapter 14 Cost Accounting Standards on Depreciation and Amortisation

Chapter 15 Case Laws on Depreciation

Chapter 16 Depreciation Requirements under Competition Act

Chapter 17 Depreciation under Income Tax Act, 1961 and Reporting under Clause 18 of Form 3CD

Chapter 18 Unabsorbed Depreciation under the Income Tax Act, 1961

Chapter 19 CBDT Clarifications on Depreciation under Income Tax Act, 1961

Appendix 1 Schedule II of Companies Act, 2013 versus Schedule XIV of Companies Act, 1956

Appendix 2 Dividends — Declaration of — Computation of Depreciation under Straight Line Method as Contemplated In Clause (b) of Sub-Section (2) — Certain Queries Answered

Appendix 3 Dividends — Declaration of — Accounting Standard (AS) 6 on Depreciation Accounting based on General Principles of Accounting issued by the Council of the Institute of Chartered Accountants of India

Appendix 4 Commencement of Provisions of the Companies Act, 2013 with regard to Maintenance of Books of Accounts and Preparations/Adoption/Filing of Financial Statements, Auditors Report, Board’s Report and Attachments to such Statements

Appendix 5 Depreciation [Rule 5]

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | CA KAMAL GARG |

| EDITION | 2024 |

| ISBN | 9788119565320 |

| PUBLICATION | BHARAT LAW HOUSE (PVT) LTD |

Reviews

There are no reviews yet.