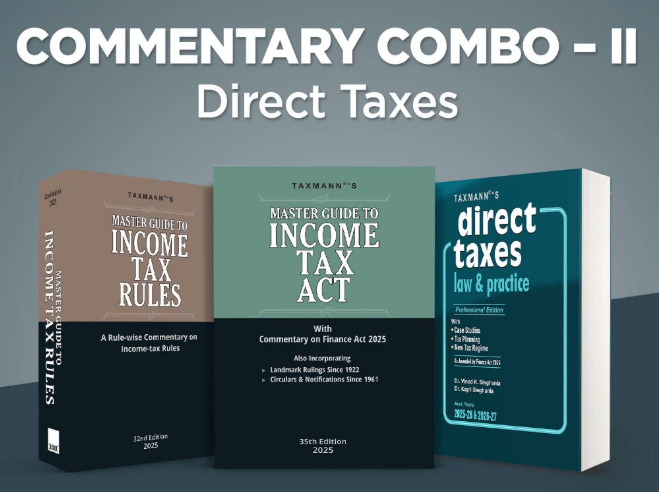

COMMENTARY COMBO for Direct Taxes – Master Guide to Income Tax Act 2025 and Rules 2025 & Direct Taxes Law & Practice | Finance Act 2025 | IT (5th Amdt.) Rules 2025 | Set of 3 Books – by Vinod K. Singhania, Kapil Singhania

Original price was: ₹10,740.00.₹7,835.00Current price is: ₹7,835.00.

COMMENTARY COMBO for Direct Taxes – Master Guide to Income Tax Act 2025 and Rules 2025 & Direct Taxes Law & Practice | Finance Act 2025 | IT (5th Amdt.) Rules 2025 | Set of 3 Books – by Vinod K. Singhania, Kapil Singhania

Description

The COMMENTARY COMBO – II for Direct Taxes is a meticulously curated set of three authoritative books that offer an all-encompassing exploration of India’s direct tax regime. Updated to incorporate amendments introduced by the Finance Act 2025 and the Income-tax (Fifth Amendment) Rules 2025, these books are designed to serve as definitive references. Each volume in this Combo addresses a different dimension of direct taxation:

- Master Guide to Income Tax Act

- Master Guide to Income Tax Rules

- Direct Taxes Law & Practice – Professional Edition

Collectively, they provide:

- Thorough legal commentary and rule-wise analysis

- Practical illustrations and examples

- Landmark judicial rulings and relevant circulars/notifications

- Comprehensive coverage of compliance requirements, procedural aspects, and strategic tax planning

This Combo is intended for the following audience:

- Tax Professionals, Chartered Accountants, and Consultants

- Lawyers & Legal Practitioners

- Corporate Finance Departments & CFOs

- Academicians & Researchers

- Government Officials & Regulators

The key features of the Combo are as follows:

- [Complete & Current] It encompasses all amendments introduced by the Finance Act 2025 and the Income-tax (Fifth Amendment) Rules 2025. Also, it reflects the latest notifications, circulars, case laws, and relevant policy directives

- [Authoritative Commentary] It delivers expert guidance from renowned authors and Taxmann’s Editorial Board, ensuring reliability and practical applicability. It also includes step-by-step explanations, practical examples, and an in-depth discussion of key legal amendments

- [Historical & Contemporary Insights] It showcases significant judicial rulings from as early as 1922, mapping the evolution of income tax law. This provides a robust understanding of the historical context as well as the most recent legal interpretations

- [User-friendly Format & Navigation] It includes a logical segmentation with chapter-wise detailing. Tables, charts, and cross-references are included for quick lookups and structured reading. Lastly, thorough indexing, footnotes, and endnotes guide readers to primary statutory sources

- [Practical Tools & Illustrations] It contains 600+ illustrations, examples, checklists, TDS/TCS tables, and ready references, which simplifies complex topics like transfer pricing, new presumptive taxation for non-residents, and GAAR provisions

- [Comprehensive Coverage] Addresses every facet of direct taxes: from basic concepts, heads of income, and deductions to advanced issues like business restructuring, international taxation, and anti-avoidance

The coverage of each book is as follows:

- Master Guide to Income Tax Act

- Finance Act 2025 Amendments

- Tax rates, deductions, and changes to TDS/TCS

- New presumptive tax scheme for non-residents under Section 44BBD

- Extended provisions for charitable trusts, widened definitions for Virtual Digital Assets, and updates to search & seizure

- Comprehensive Analysis & Case Laws

- Landmark rulings (1922–Feb 2025) from the Supreme Court/High Courts

- Government notifications and CBDT circulars

- Detailed Divisions

- Division One – Commentary on amendments introduced by the Finance Act 2025

- Division Two – TDS & TCS tables for quick reference

- Division Three – Circulars, clarifications & notifications (1961–Feb 2025)

- Division Four – Landmark judicial rulings (1922–Feb 2025)

- Finance Act 2025 Amendments

- Master Guide to Income Tax Rules

- Rule-by-rule Analysis

- Covers the Income-tax Rules, 1962, from Rule 2A to Rule 134

- Detailed commentary, operative circulars, notifications, relevant judicial precedents

- Valuation & Compliance

- Valuation of perquisites, depreciation, capital gains, and record-keeping

- TDS/TCS procedures, forms, certificates, and statements

- Special Provisions & Schemes

- Transfer pricing, GAAR, infrastructure debt funds, charitable institutions, etc.

- Annexures & Cross-Referencing

- Texts of related circulars, notifications, and forms

- Legislative background, purpose, and real-world application explained with examples

- Rule-by-rule Analysis

- Direct Taxes Law & Practice – Professional Edition

- Comprehensive & Lucid Presentation

- Explains direct tax provisions for AYs 2025-26 & 2026-27 through 600+ illustrations and case studies

- Focus on New Tax Regimes & Tax Planning

- Covers the practical impact of the new tax regime (Section 115BAC), including strategies and planning avenues

- Discusses MAT (Minimum Alternate Tax), Transfer Pricing, Business Restructuring, GAAR, etc.

- Step-by-step Procedures

- Covers assessments, appeals, revisions, penalties, and prosecutions

- Includes frequently asked questions (FAQs) to resolve common queries

- Comprehensive & Lucid Presentation

The structure of the Combo is as follows:

- Logical Segmentation – Each book is divided into structured parts/divisions to handle specific areas of the law (e.g., commentary on recent amendments, TDS/TCS, notifications, or heads of income)

- Chapter-wise Detailing

- Chapters progress from foundational concepts like definitions and scope of income to advanced topics like search & seizure, Transfer Pricing, and GAAR

- Para-wise commentary and cross-referencing to relevant circulars, notifications, or sections

- Illustrations & Examples

- Step-by-step computations for undisclosed income, presumptive schemes, or block assessments

- Practical illustrations clarify complex theoretical provisions

- Cross-references & Indexing

- Extensive cross-references to help locate discussions in all three volumes

- Comprehensive indexing for quick lookups, making it equally suitable for daily use and deep research

- Annexures & FAQs

- Contains statutory references, forms, and schedules

- Provides frequently asked questions for quick clarity on common issues

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | VINOD K SINGHANIA & KAPIL SINGHANIA |

| EDITION | 2025 |

| ISBN | 9789364551373, 9789364552103, 9789364554084 |

| PUBLICATION | TAXMANN PUBLICATIONS |

Reviews

There are no reviews yet.