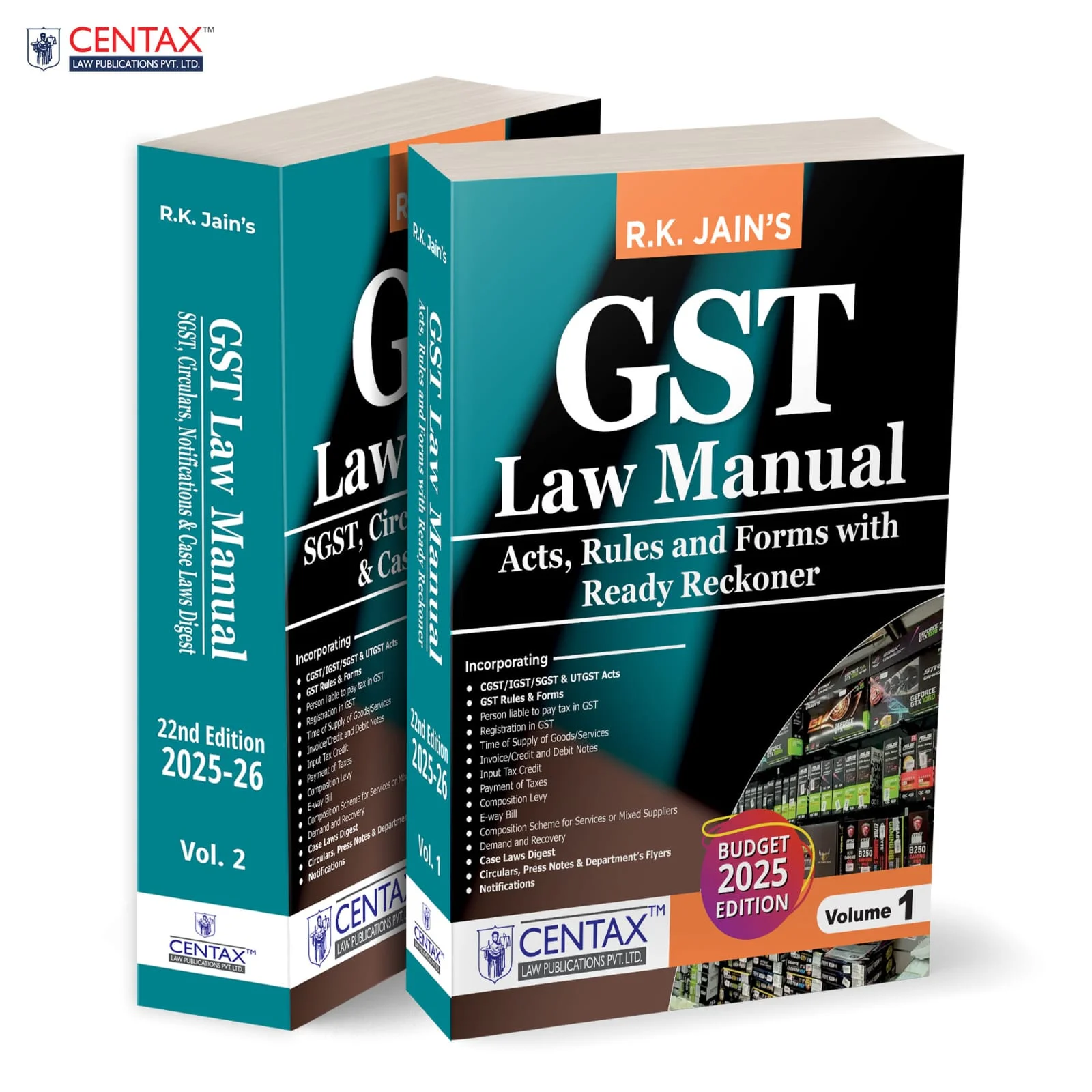

Centax GST Tariff of India (Set of 2 Volumes) by R K Jain – Edition 2025-2026

Original price was: ₹3,895.00.₹3,270.00Current price is: ₹3,270.00.

Centax GST Tariff of India (Set of 2 Volumes) by R K Jain – Edition 2025-2026

Out of stock

Description

Centax GST Tariff of India and GST Rates by R K Jain.

R.K. Jain’s GST Tariff of India is a comprehensive and authoritative guide that consolidates all critical aspects of India’s Goods and Services Tax (GST) framework. The book covers GST rates, exemptions, notifications, classifications, and interpretative rules for goods (up to 8 digits of HSN codes) and services, giving a one-stop reference for every GST-related query or compliance requirement. The hallmark of this publication is its structured, user-friendly approach to an otherwise complex subject, combining legal exactitude with practical insights.

This book is intended for the following audience:

- Chartered Accountants, Company Secretaries, and Cost Accountants requiring an up-to-date reference for client advisory and statutory audits

- Lawyers and Tax Consultants dealing with tax litigation, interpretation of notifications, and opinions on complex GST matters

- Corporate Tax and Finance Teams aiming to maintain compliant records and manage GST returns and day-to-day operations

- Government Officials and Regulators looking for a consolidated source of GST-related enactments, rates, and procedural rules

- Academicians and Students specialising in taxation, law, or commerce who need a reliable compendium for learning and research

The Present Publication is the 22nd Edition | 2025-26, authored by R.K. Jain and edited by CA. (Dr) Arpit Haldia. It is updated until 1st February 2025, with the noteworthy features:

- [Most Up-to-date Content] Reflects GST amendments, notifications, circulars, press releases, and case law up to 1st February 2025

- [Two-volume Format] Volume 1 focuses on Goods (Chapters 1–98 of GST Tariff), while Volume 2 discusses Services (Chapter 99), IGST, Compensation Cess, Reverse Charge Mechanism, and more

- [8-Digit HSN Coverage] Comprehensive classification for goods, ensuring precise tax rate identification

- [Service Codes & SAC] Clearly explains service accounting codes (SAC) and rates for various categories of services

- [Ready Reckoners & Comparative Tables] Summaries for quick reference on GST rates and exemptions, saving valuable time

- [Notifications & Exemptions] Exhaustive compilation of relevant GST notifications (CGST, SGST, UTGST, IGST) and exemption lists

- [Reverse Charge Mechanism (RCM)] Separate section detailing RCM for both goods and services, with easy-to-understand examples

- [Practical Insights & FAQs] Includes frequently asked questions, circulars, and advance rulings to clarify nuanced points of law

- [Extensive Alphabetical Index] Commodity- and service-wise indexes for hassle-free navigation

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | R K Jain |

| EDITION | 2025 |

| ISBN | 9789391055561 |

| PUBLICATION | CENTAX PUBLICATION |

Reviews

There are no reviews yet.