Sale!

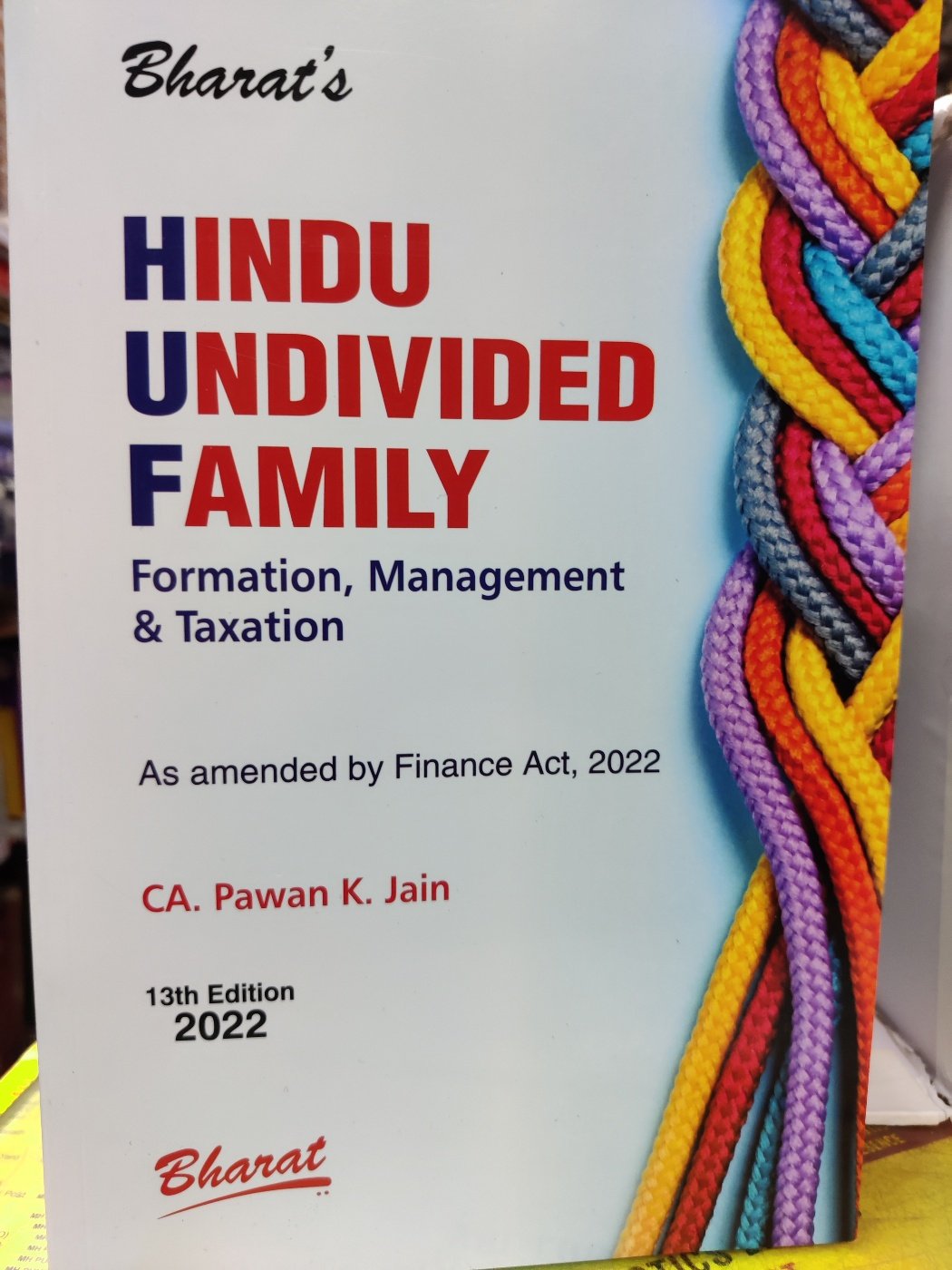

BHARAT’S HINDU UNDIVIDED FAMILY(AS AMENDED BY FINANCE ACT 2022)-CA PAWAN K JAIN

Original price was: ₹1,295.00.₹971.00Current price is: ₹971.00.

This book is a complete practical guide for all professionals and taxpayers on matters related to Hindu Undivided Family.

The book contains provisions on taxation matters necessary for HUF for computation of taxable income, TDS and other matters. ITR forms applicable to HUF have been given. Various types of formats have been given at appropriate places for creation/declaration of HUF, partition of HUF and adoption etc.

In this book, we have given detailed analysis of all codified Hindu Laws supported by the judgments of the Supreme Court and various High Courts. However there are number of judgments available on the matters but in this book we have given only those judgments which are less controversial and practical for taxation purposes.

About the Author

CA. PAWAN K. JAIN, M.Com, FCA, DISA (ICA) is a Practicing Chartered Accountant engaged in the consultancy on taxation matters, project finance and other related matters. He is engaged in providing consultancy from concept to commissioning for agro based and food processing industries. He is having practical experience of more than 24 years on these matters.

Mr. Jain has authored several books for professionals on topics related to direct taxes. He has also contributed several articles on taxation matters in various magazines of the professional subjects.

Mr. Jain is the Vice Chairman of the Institute of Corporate Directors of India, a non profit making organization working for corporate governance.

Out of stock

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | CA PAWAN K JAIN |

| EDITION | 13th |

| ISBN | 978993749635 |

| PUBLICATION | BHARAT LAW HOUSE (PVT) LTD |

| YEAR OF PUBLICATION | 2022 |

Reviews

There are no reviews yet.