Sale!

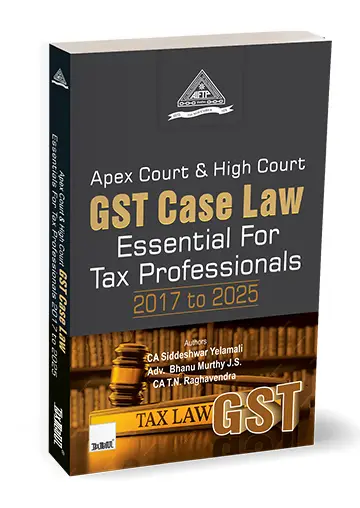

Apex Court & High Court GST Case Law By AIFTP – 1st Edition 2026

Original price was: ₹725.00.₹635.00Current price is: ₹635.00.

Apex Court & High Court GST Case Law By AIFTP – 1st Edition 2026

Description

The Present Publication is the Latest Edition, commissioned by AIFTP and published exclusively by Taxmann. It is authored by CA. Siddeshwar Yelamali, Adv. Bhanu Murthy J.S. & CA. T.N. Raghavendra, with the following noteworthy features:

- [Comprehensive Coverage of High-Impact Judgments] The book captures rulings that define the GST architecture:

- Mohit Minerals (SC) – Ocean freight levy

- Safari Retreats (SC) – ITC on immovable property

- Radha Krishan Industries (SC) – Provisional attachment safeguards

- CERC, Goa University, Bengaluru North University – Taxability of statutory bodies

- Tonbo Imaging, AU Finja Jewels – Export refund valuation

- Multiple rulings on Rule 86A, Section 83, Sections 129/130, Section 69 (arrest), Section 16(4)

- [Thematically Organised for Practical Use] Judgments are arranged into 25 chapters covering:

- Supply | Levy | Exemption | IGST | Valuation | Classification | ITC | Registration | Returns | Refund | Audit | Notices | Recovery | Attachment | Appeal | Revision | Penalties | Detention & Confiscation | Search & Seizure | Arrest | RTI | IBC interplay | Rectification | Service of Notice

- [Uniform Case-digest Format] Each ruling includes:

- Issue Involved

- Court’s Reasoning

- Findings

- Practical Implications

- [Unmatched Depth in ITC Jurisprudence] Covers time limits under Section 16(4), burden of proof under Section 16(2)(c), blocking of ledger under Rule 86A, amalgamation-related ITC transfer, towers and immovable property, portal errors, and wrong classification between IGST/CGST/SGST

- [Extensive Focus on Enforcement] Captures judicial limits on:

- Provisional attachment of bank accounts/cash credit

- Forced recovery during investigation

- Summons and arrest powers

- Search and seizure standards

- Detention without evidence of intent to evade

- [Research Utilities] Includes a detailed Table of Cases (alphabetical) and a Subject Index mapping every contentious issue to its judicial treatment.

The coverage of the book is as follows:

- Parallel Proceedings

- Supreme Court interpretation of Section 6(2), defining when the Centre and State are barred from simultaneous investigations

- Supply

- Mutuality, vouchers, leasehold rights, statutory functions, partial construction, business test in public bodies

- Levy & Exemption

- Re-imports, mismatch disputes, residential dwelling exemption, hostels, agricultural services, annuity in lieu of tolls

- IGST & Intermediary

- Core rulings on intermediary vs. export of service, place of supply rules, and ocean freight

- Valuation

- Land deduction, subsidy vs. discount, validity of deeming fiction, valuation caps under zero-rated supplies

- Classification

- Notable decisions include flavoured milk, composite goods, and works contracts

- ITC

- Time-bar, eligibility, blocked credits, mismatch, retrospective cancellation, amalgamation, immovable property, supplier default

- Refund

- Inverted duty structure, zero-rated supplies, valuation disputes, compensation cess, CA-certified realisation, closure of business, delayed refunds and interest

- Registration, Returns, Audit

- Suspension and cancellation, rectification of errors, scope of audit post-cancellation, and timelines

- Notices, Recovery & Attachment

- SCN validity, portal service issues, coercive recovery, attaching cash credit, and invalid attachments through letters

- Detention & Confiscation (Sections 129 & 130)

- Requirement of intent, necessity of reasoned order, distinction between detention and confiscation

- Search, Seizure, Summons & Arrest

- Role of ‘reasons to believe’, safeguards under Radhika Agarwal, applicability of Arnesh Kumar principles, procedural rights, bail jurisprudence

- IBC & GST Interplay

- Whether GST liabilities survive resolution, treatment of claims, and the impact of the moratorium

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | AIFTP |

| EDITION | 2026 |

| ISBN | 9789375610618 |

| PUBLICATION | TAXMANN PUBLICATIONS |

Reviews

There are no reviews yet.