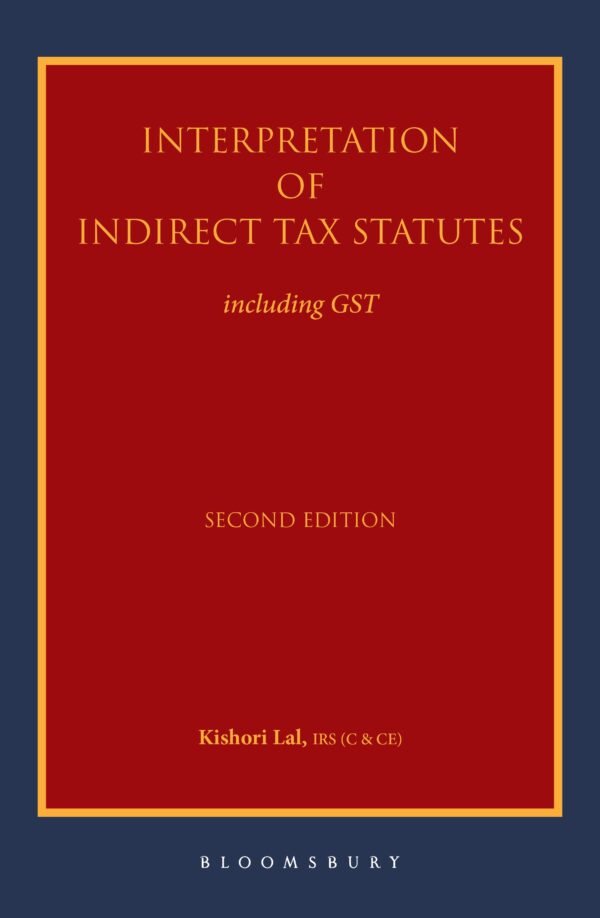

INTERPRETATION OF INDIRECT TAX STATUTES INCLUDING GST

Original price was: ₹3,399.00.₹2,550.00Current price is: ₹2,550.00.

Keynote

This book provides readers with the way courts have interpreted indirect tax statutes with reference to case laws, sections and delegated legislation. Arranged under major concepts, the insight provided will be beneficial to judges, justices, practitioners, tax officials and to law colleges.

Description

Highlights of the book

– Concepts of interpretation of tax statutes lucidly explained

– An exclusive chapter on Goods and Services Tax, A separate chapter on Service Tax

– Exhaustive coverage on Natural Justice and Theory of precedent

– Special emphasis on the decisions of the CESTAT, on all topics

– New Chapters added to this edition

o Sabka Vishwas (Legacy Dispute Resolution) Scheme

o Res judicata

– Comprehensive coverage of cases on Levy of Customs, Central Excise, Service tax and GST, Classification of goods and services, Exemption, Valuation of goods and services, CENVAT Credit/Input Tax Credit, Recovery of Tax dues, Refund/Rebate, Small Scale Exemption

About the author

The author is an officer of Customs, Central Excise & Service Tax Department belonging to 1989 batch of IRS (C & CE). He has worked in various capacities inthe Department dealing with Customs, Central Excise, Service Tax, Narcotics and Goods and Service Tax.

He has more than 31 years of experience including 4 years of experience in representing the Department’s cases before the Customs, Central Excise & Service Tax Appellate Tribunal(CESTAT) pertaining to Customs, Central Excise & Service Tax.

Out of stock

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | KISHORI LAL |

| EDITION | 2nd |

| ISBN | 9789354355585 |

| PUBLICATION | BLOOMSBURY |

| YEAR OF PUBLICATION | 2021 |

Reviews

There are no reviews yet.