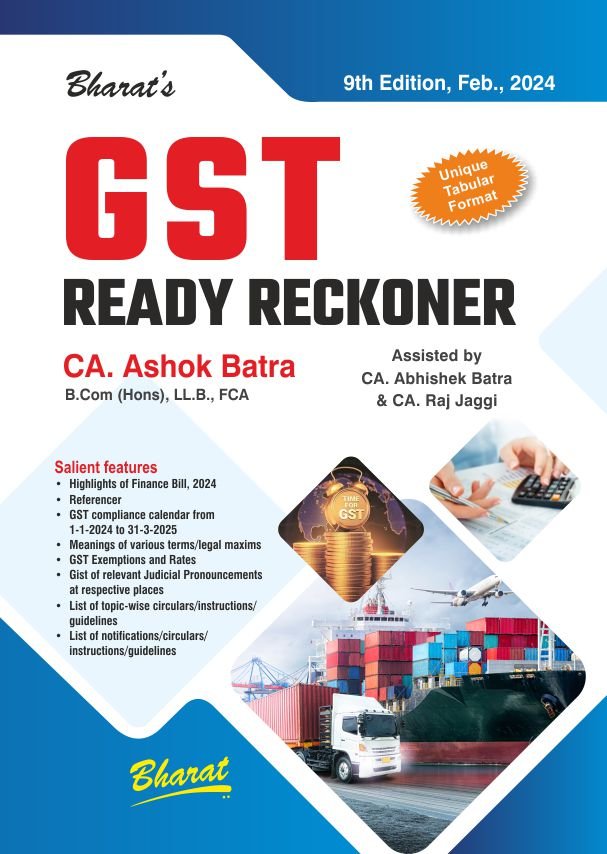

GST Ready Reckoner by CA Ashok Batra – 9th Edition 2024

Original price was: ₹2,650.00.₹1,975.00Current price is: ₹1,975.00.

GST Ready Reckoner by CA Ashok Batra – 9th Edition 2024

Description

Division 1

Referencer

GST Compliance Calendar for January, 2024 to March, 2025

Referencer 1 Meanings of various terms

Referencer 1A Meanings of legal words, maxims/phrases

Referencer 1B Rules of interpretation of statutes including Doctrines

Referencer 1C List of section-wise/rule-wise commentary in differenChapters

Referencer 2 Extension of due dates for different returns

Referencer 3 State/UT Codes

Referencer 4 Rate of interest payable under different situations

Referencer 5 Important points regarding Summons under section 7of the CGST Act

Referencer 6 Penalties, late fee and fine under GST Act(s)

Referencer 7 Illustrative cases in which penalty or late fee has beewaived

Referencer 8 Prosecution under GST Act(s) – Sections 132 and 133

Referencer 9 Various forms under GST

Referencer 10 Different types of persons under GST

Referencer 11 Various types of supply under GST

Referencer 12 Suggestive Format of Tax Invoice, Bill of SupplyReceipt Voucher, Refund Voucher Etc.

Referencer 13 Scheme of broad classification of goods under GST

Referencer 14 Scheme of broad classification of services under GST

Referencer 15 List of topic-wise Circulars/Instructions/Guidelineetc.

Referencer 16 Supply of Goods under Reverse Charge Mechanism

Referencer 17 Supply of Services under Reverse Charge Mechanism

Division 2

Practice and Procedure

Chapter 1 Introduction and Overview of GST

Chapter 2 Concept of supply including Intra-State & Inter-State Supply

Chapter 3 Place of supply of goods or services or both

Chapter 4 Zero-Rated Supply (including Exports) and Imports

Chapter 5 Levy of Tax

Chapter 6 Registration

Chapter 7 Electronic Commerce including TCS

Chapter 8 Valuation of Taxable Supply

Chapter 9 Input Tax Credit

Chapter 10 Time of Supply and Payment of Tax

Chapter 11 Reverse Charge under GST

Chapter 12 Tax Invoice, Credit and Debit Notes

Chapter 13 Returns

Chapter 14 Refunds

Chapter 15 Accounts and Records

Chapter 16 Offences, Penalties and Prosecution

Chapter 17 Assessment under GST

Chapter 18 Audit under GST

Chapter 19 Inspection, Search, Seizure, Arrest and E-Way Rules

Chapter 20 Demands and Recovery

Chapter 21 Appeals and Revision

Chapter 22 Advance Ruling

Chapter 23 Liability to pay in certain cases

Division 3

Exempted Goods and GST Rates on Goods

Part A Exempted goods under GST Acts namely CGST Act, IGST Acand respective SGST Acts

Part B Exempted Goods under IGST Act only

Part C CGST Rates of Goods with HSN Codes

Part D Exemption from compensation cess on supply of goods

Part E Compensation Cess rates on supply of specified goods

Division 4

Exempted Services and GST Rates on Services

Part A Exempted Services under CGST, IGST and SGST Acts

Part B Exempted services under IGST Act Only

Part C CGST rates of services with accounting codes

Part D Scheme of Classification of Services

Part E Compensation cess rates on services

Division 5

List of Notifications/Circulars/ Orders/

ROD Orders/Press Releases

Part A List of Central Tax [CT] Notifications

Part B List of Central Tax (Rate) Notifications

Part C List of Integrated Tax [IT] Notifications

Part D List of Integrated Tax (Rate) Notifications

Part E List of Compensation Cess Notifications

Part F List of Compensation Cess (Rate) Notifications

Part G List of Central Tax Circulars

Part H List of Integrated Tax Circulars

Part I List of Compensation Cess Circulars

Part J List of Central Tax Orders

Part K List of CGST (Removal of Difficulties) Orders

Part L List of Instructions and Guidelines

Part M List of press releases issued by CBIC

Part N List of press releases issued by GSTN

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | ASHOK BATRA |

| EDITION | 2024 |

| ISBN | 9788196900052 |

| PUBLICATION | BHARAT LAW HOUSE (PVT) LTD |

Reviews

There are no reviews yet.