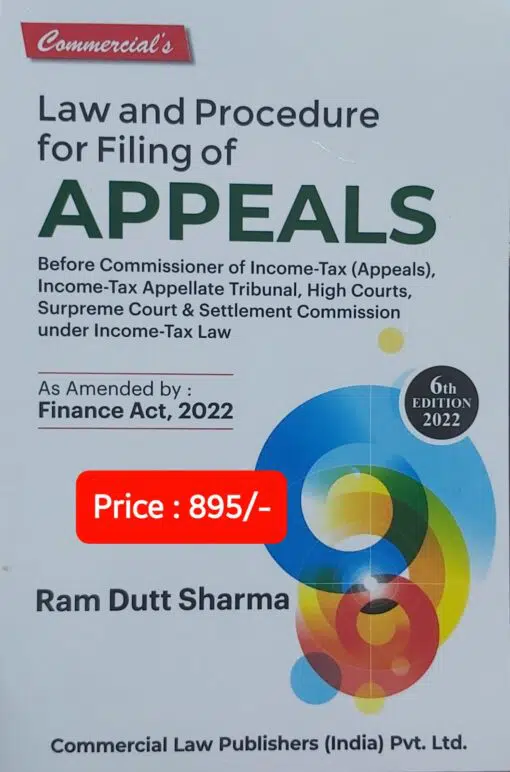

Commercial’s Law and procedure of Filing of Appeals by Ram Dutt Sharma

Original price was: ₹895.00.₹671.00Current price is: ₹671.00.

Commercial’s Law and procedure of Filing of Appeals by Ram Dutt Sharma – 6th Edition 2022.

Commercial’s Law and procedure of Filing of Appeals by Ram Dutt Sharma – 6th Edition 2022.

About the book

Taxpayers, particularly small taxpayers, are still not very well aware of the course of action available to them in case they do not agree with the decisions of the Income Tax Authorities. This book is our endeavour to educate the taxpayers about the appellate proceedings under the Income Tax Law.

When a taxpayer is adversely affected by orders as passed by the Assessing Officer, he can file an appeal. The book lists out the Forms in which Appeals can be filed, how to fill the same, who will sign the Form, authority with whom appeals should be filed, language to be used in the Forms and fees to be paid, etc.

In this book, an attempt to overcome the need of Department as well as professionals who want to equip themselves by making the book look easy. This book provides the necessary guidance in the area of how to file appeal at the levels of first, second, third and fourth appeals in direct taxes. It also describes the procedural aspects of appeal, also includes all the relevant amendments made by the Finance Act, 2022 and Notifications, Circulars, Instructions and other departmental release as on date. References to the latest and landmark judgements have been provided with relevant paragraphs. Reproduction of relevant section, Rules for ready reference of readers has also been made at the relevant places.

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | RAM DUTT SHARMA |

| ISBN | 9789356030619 |

| PUBLICATION | COMMERCIAL LAW PUBLISHERS (INDIA) PVT LTD |

| YEAR OF PUBLICATION | 2022 |

Reviews

There are no reviews yet.