Skip to content

-

-

Sale!

- Budget, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

₹2,695.00 Original price was: ₹2,695.00.₹2,000.00Current price is: ₹2,000.00.

- Add to cart

-

-

Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

₹2,695.00 Original price was: ₹2,695.00.₹1,967.00Current price is: ₹1,967.00.

- Add to cart

-

-

Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

₹2,895.00 Original price was: ₹2,895.00.₹2,150.00Current price is: ₹2,150.00.

- Ind AS Practices Demystified By CA Santosh Maller - Edition 2023

- Add to cart

-

-

Sale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

₹795.00 Original price was: ₹795.00.₹675.00Current price is: ₹675.00.

- Independent Directors – A Ready Referencer by Dr. Sanjeev Gupta - 1st Edition 2025

- Add to cart

-

-

Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

₹2,195.00 Original price was: ₹2,195.00.₹1,645.00Current price is: ₹1,645.00.

- INDIAN ACCOUNTING STANDARDS (Ind AS) - Edition 2025vvvv

- Add to cart

-

-

Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

₹7,995.00 Original price was: ₹7,995.00.₹5,565.00Current price is: ₹5,565.00.

- INDIAN ACCOUNTING STANDARDS (Ind AS) by Dolphy D Souza (Set of 3 Vols.) - 7th Edition 2025

- Add to cart

-

-

Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

₹7,995.00 Original price was: ₹7,995.00.₹5,995.00Current price is: ₹5,995.00.

- Add to cart

-

-

Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

₹9,995.00 Original price was: ₹9,995.00.₹7,495.00Current price is: ₹7,495.00.

- Indian Accounting Standards & Corporate Accounting Practices By T P Ghosh (Set of 3 Vols.) - 10th Edition 2026

- Preorder Now!

-

-

Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

₹3,450.00 Original price was: ₹3,450.00.₹3,100.00Current price is: ₹3,100.00.

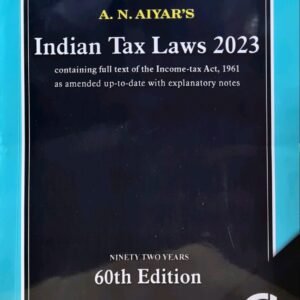

- Indian Tax Laws 2023 by A. N. Aiyar - containing full text of the Income-tax Act, 1961 as amended up-to-date with explanatory notes

- Add to cart

-

-

Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

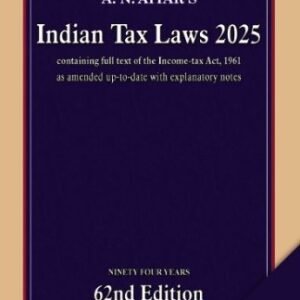

₹2,975.00 Original price was: ₹2,975.00.₹2,495.00Current price is: ₹2,495.00.

- Indian Tax Laws 2025 by A.N. Aiyar - 62nd Edition 2025

- Add to cart

-

-

Out of Stock

Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

₹1,725.00 Original price was: ₹1,725.00.₹1,465.00Current price is: ₹1,465.00.

- Read more

-

-

Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

-

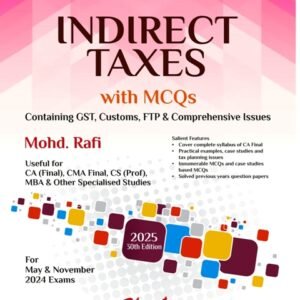

₹1,775.00 Original price was: ₹1,775.00.₹1,420.00Current price is: ₹1,420.00.

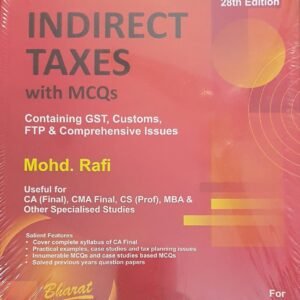

- INDIRECT TAXES (With MCQs) Containing GST, Customs, FTP & Comprehensive Issues

- Add to cart