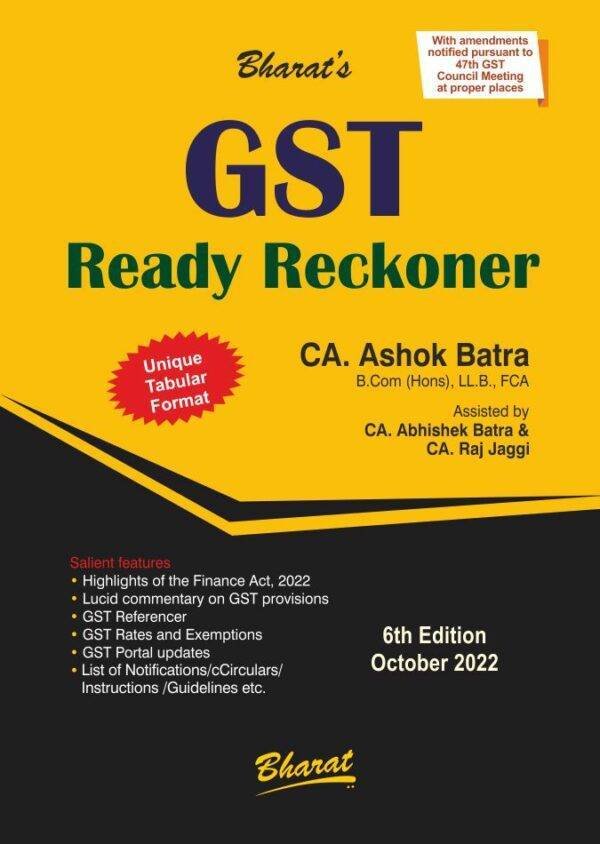

Goods and Service Tax Ready Reckoner By Ashok Batra 2022 Edition

Original price was: ₹2,395.00.₹1,795.00Current price is: ₹1,795.00.

Bharat Goods and Service Tax Ready Reckoner By Ashok Batra

Bharat Goods and Service Tax Ready Reckoner By Ashok Batra

Description

GST Ready Reckoner explains the provisions with numerous practical examples, making it a unique feature of this book. The book covers GST Rates on Taxable Supplies (including Exempted Goods & Services), lucid commentary on GST provisions, taking into consideration the interest and inclination of the readers and also to facilitate improved understanding of the provisions of the GST Act(s) and Rules.

The content of the book has been sub-divided as under:

- Division I (a) Highlights of the Finance Act 2022

- Division II Exempted Goods and GST Rates on Goods

- Division IIII Exempted Services and GST Rates on Services

- Division IV Practice and Procedure

Key Features:

- Highlights of Finance Act 2022

- Lucid Commentary on GST Provisions

- Gist of Notifications/ Circulars/ Clarifications/ Orders

- GST Referencer

- GST Rates on Taxable Supplies

- Exemptions under GST.

CA Ashok Batra is a Renowned Service tax practitioner, dealing in wide range of practical aspects of Service Tax by engaging in Advisory, Compliance and Litigation functions. He has been taken as co-opted member/Special Invitee of Indirect Taxes Committee of ICAI ever since its inception. He is also a faculty of Certificate Course in Indirect Taxes of ICAI at many leading centers .Furthermore, he is invited to deliver Lectures in respect of Service Tax Proposals and Amendments by many Study Circles, Branches and/or Regional Councils of ICAI, ICSI and other professional bodies, Department, as well as by leading Chambers of Commerce and Industry and Media Channels. He is also an author to 7 titles on Service Tax and 2 titles of Delhi Vat.

Out of stock

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | ASHOK BATRA |

| ISBN | 9789394163348 |

| PUBLICATION | BHARAT LAW HOUSE (PVT) LTD |

| YEAR OF PUBLICATION | 2022 |

Reviews

There are no reviews yet.