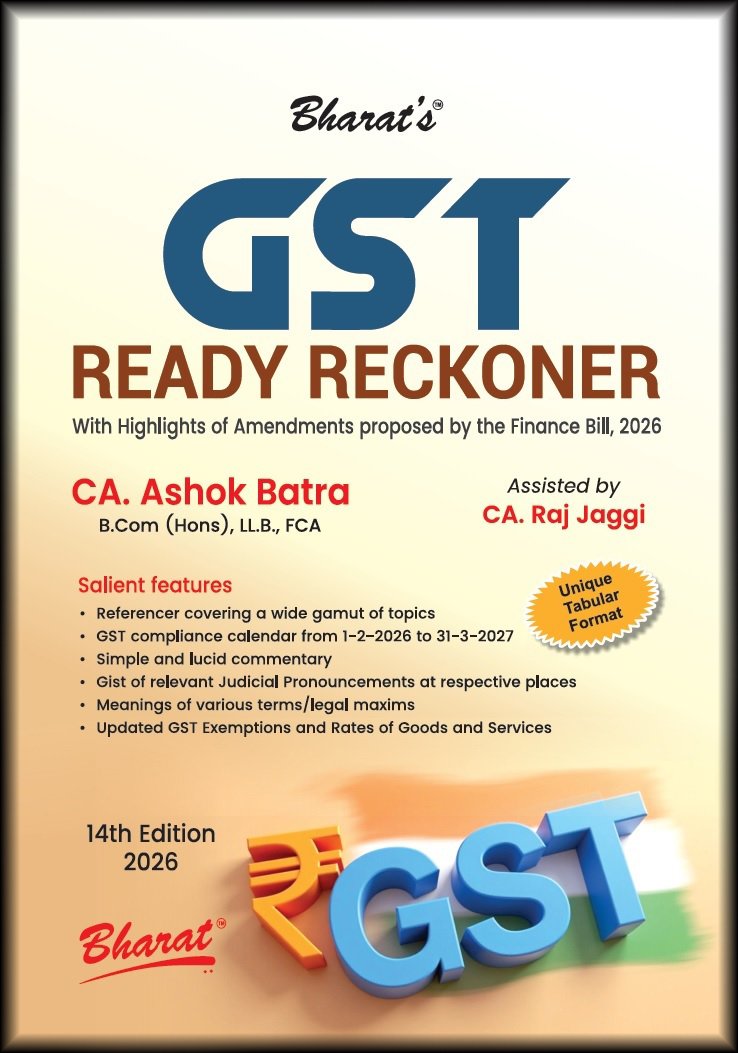

GST Ready Reckoner by CA. Ashok Batra – 14th Edition 2026

Original price was: ₹3,250.00.₹2,435.00Current price is: ₹2,435.00.

GST Ready Reckoner by CA. Ashok Batra – 14th Edition 2026

Description

Division 1

Referencer

| GST Compliance Calendar for February, 2026 to March, 2027 | ||

| Referencer 1 | Meanings/Definitions of Various Terms used in GST | |

| Referencer 2 | Meanings of Legal Terms and Phrases | |

| Referencer 3 | Principles of Interpretation of Statutes including GST Acts | |

| Referencer 4 | List of section-wise/rule-wise commentary in different Chapters of Ready Reckoner | |

| Referencer 5 | List of Section-wise Rules and Departmental Circulars, Instructions, Orders etc. | |

| Referencer 6 | GST Portal | |

| Referencer 7 | List of Extended Due Dates for Various GST Returns | |

| Referencer 8 | Time-Barred Limits for Issuance of SCNs and Orders for Various Years | |

| Referencer 9 | Interest Payable under Different Situations and its rates | |

| Referencer 10 | An Overview of Summons issued u/s 70 | |

| Referencer 11 | Penalties, Late Fees and Fines Applicable in Various Situations | |

| Referencer 12 | Illustrative Cases of Waiver of Penalty, Late Fee, and Interest | |

| Referencer 13 | Prosecution & Penal Provisions of Sections 132 & 133 | |

| Referencer 14 | List of Various GST Forms | |

| Referencer 15 | Definitions of Various Types of Persons | |

| Referencer 16 | Definitions of Various Types of GST Supplies | |

| Referencer 17 | Model Templates for Tax Invoices, Bills of Supply, Receipt Vouchers, Refund Vouchers and Other Essential Documents | |

| Referencer 18 | Scheme of Broad Classification of Goods under GST | |

| Referencer 19 | Scheme of Broad Classification of Services under GST | |

| Referencer 20 | List of Topic-Wise Circulars/Instructions/Guidelines etc. | |

| Referencer 21 | Supplies of Goods Liable to Reverse Charge under GST | |

| Referencer 22 | Supplies of Services Liable to Reverse Charge under GST | |

| Referencer 23 | List of Services Subject to Tax Payment by Electronic Commerce Operators (ECOs) | |

| Referencer 24 | GST Amnesty Scheme 2024: Relief Provisions under Section 128A | |

| Referencer 25 | Procedure & Conditions for closure of proceedings under section 128A in r/o demands issued u/s 73 | |

| Referencer 26 | Taxpayers who shall not be eligible to avail GST Amnesty Scheme, 2024 | |

| Referencer 27 | Critical Deadlines for GST Amnesty Scheme, 2024 | |

| Referencer 28 | FAQs on GST Amnesty Scheme, 2024 | |

| Referencer 29 | GST State/UT Jurisdictional Codes | |

| Referencer 30 | Electronic Invoicing (E-Invoicing) under GST | |

| Referencer 31 | List of Latest Notifications, Circulars, FAQs, Press Releases, etc. issued under NextGen GST Reforms in September, 2025 | |

| Referencer 32 | Comparison of Schedules under Goods Rate Notifications | |

| Referencer 33 | Amended Rates of Tax on Services & ITC Eligibility (Full, Restricted, or Nil) – Effective from 22.09.2025 | |

| Referencer 34 | Staggered Filing Schedule for E-Filing of Appeal before GSTAT | |

Division 2

Practice and Procedure

Chapter 1 Introduction and Overview of GST

1.0 Introduction

1.1 Features of GST

1.2 Integrated Goods and Services Tax

1.2.1 Introduction

1.2.2 Definition

1.2.3 Adoption of “Dual GST” Model

1.2.4 Scope of IGST

1.2.5 Advantages of IGST model

1.2.6 Application of the provisions of CGST Act, 2017 – Section 20 of the IGST Act

1.2.7 Treatment of exports under IGST

1.3 Administration of GST

1.3.1 Appointment of officers by the Government – Section 3 of the CGST Act, 2017

1.3.2 Appointment of officers by the Board – Section 4 of the CGST Act, 2017

1.3.3 Powers of officers – Section 5 – Enforceable with effect from 22.06.2017- N. No. 01/2017-CT (22.06.2017)

1.3.4 Officers appointed under State/UT authorised to be ‘proper officer’ under CGST Act in certain circumstances – Section 6 – Enforceable with effect from 01.07.2017- N. No. 09/2017-CT(28.06.2017)

1.4 GST Portal Updates

Chapter 2 Concept of supply including Intra-State & Inter-State Supply

2.0 Introduction

2.1 Meaning and scope of supply – Section 7 of the CGST Act, 2017 – Enforceable with effect from 01.07.2017- N. No. 09/2017-CT (28.06.2017)

2.1.1 Inclusions in the term ‘supply’ – Section 7(1)(a)

2.1.2 Future supply shall also be covered

2.1.3 Supply must be made for a ‘consideration’

2.1.4 Supply must be made by a person

2.1.5 Supply need not be made by one person to another

2.1.6 Insertion of Section 7(1)(aa) with retrospective effect from 01.07.2017 — Section 108 Finance Act, 2021 – N. No. 39/2021-CT, dated 21.12.2021

2.1.7 Supply must be made in the course or furtherance of business — Section 7(1)(b)

2.1.8 Supply includes import of services, for a consideration, whether or not in the course or furtherance of business – Section 7(1)(b)

2.1.9 Activities specified in Schedule I, made or agreed to be made without a consideration – Section 7(1)(c)

2.1.9.1 Permanent transfer or disposal of business assets where input tax credit has been availed on such assets – Paragraph 1 of Schedule I of the CGST Act, 2017

2.1.9.2 Supply of goods or services or both even if made without consideration between related persons or between distinct persons as specified in Section 25, when made in the course or furtherance of business – Paragraph 2 of Schedule I of the CGST Act, 2017

2.1.9.3 Supply of goods by a principal to his agent or vice versa – Paragraph 3 of Schedule I

2.1.9.4 Import of services by a person, from a related person or from any of his other establishments outside India, in the course or furtherance of business – Paragraph 4 of Schedule I

2.1.10 Activities to be treated as supply of goods or services – Section 7(1A) [notified with retrospective effect from 01.07.2017]

2.1.10.1 Any transfer of the title in goods is a supply of goods – Paragraph 1(a) of Schedule II

2.1.10.2 Any transfer of right in goods or of undivided share in goods without the transfer of title thereof, is a supply of services – Paragraph 1(b) of Schedule II

2.1 10.3 Any transfer of title in goods under an agreement which stipulates that property in goods will pass at a future date upon payment of full consideration as agreed, is a supply of goods – Paragraph 1(c) of Schedule II

2.1.10.4 Any lease, tenancy, easement, license to occupy land is a supply of services – Paragraph 2(a) of Schedule II

2.1.10.5 Any lease or letting out of the building for business or commerce is a supply of services – Paragraph 2(b) of Schedule-II

2.1.10.6 Any treatment or process which is applied to another person’s goods is a supply of services – Paragraph 3 of Schedule II

2.1.10.7 Transfer or disposal of goods forming part of business assets is a supply of goods – Paragraph 4(a) of Schedule II

2.1.10.8 Goods held or used for business purposes are put to any private use or are used or made available to any person for use, the usage or making available of such goods to any person is a supply of services – Paragraph 4(b) of Schedule II

2.1.10.9 When any person ceases to be a taxable person, any goods forming part of the assets of any business carried on by him is deemed to be supplied by him – Paragraph 4(c) of Schedule II

2.1.10.10 Renting of immovable property is treated as supply of services – Para 5(a) of Schedule II

2.1.10.11 Construction of a complex, building or civil structure or part thereof is treated as supply of services – Paragraph 5(b) of Schedule-II

2.1.10.12 Temporary transfer or permitting the use or enjoyment of any intellectual property right is treated as supply of services – Paragraph 5(c) of Schedule II

2.1.10.13 Development, Design etc. of IT software is treated as supply of services –Paragraph 5(d) of Schedule II

2.1.10.14 Agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act shall be treated as supply of services – Paragraph 5(e) of Schedule II

2.1.10.15 Transfer of the right to use any goods for any purpose for cash, deferred payment or other valuable consideration shall be treated as supply of services – Paragraph 5(f) of Schedule II

2.1.10.16 Works contract in relation to any immovable property is treated as a supply of services – Paragraph 6(a) of Schedule II

2.1.10.17 Composite supply of goods being food or any other article of human consumption or any drink for cash, deferred payment or other valuable consideration is treated as a supply of services – Paragraph 6(b) of Schedule II

2.1.10.18 Supply of goods by any unincorporated association or body of persons to a member thereof for cash, deferred payment or other valuable consideration is treated as supply of goods – Paragraph 7 of Schedule II — Omitted retrospectively with effect from 01.07.2017 vide Section 122 of the Finance Act, 2021

2.1.11 Activities or transactions which shall not be treated as a “supply”

Additional information

| BINDING | PAPERBACK |

|---|---|

| AUTHOR | CA. Ashok Batra |

| EDITION | 2026 |

| ISBN | 9789347779671 |

| PUBLICATION | Bharat Law House Pvt. Ltd. |

Reviews

There are no reviews yet.