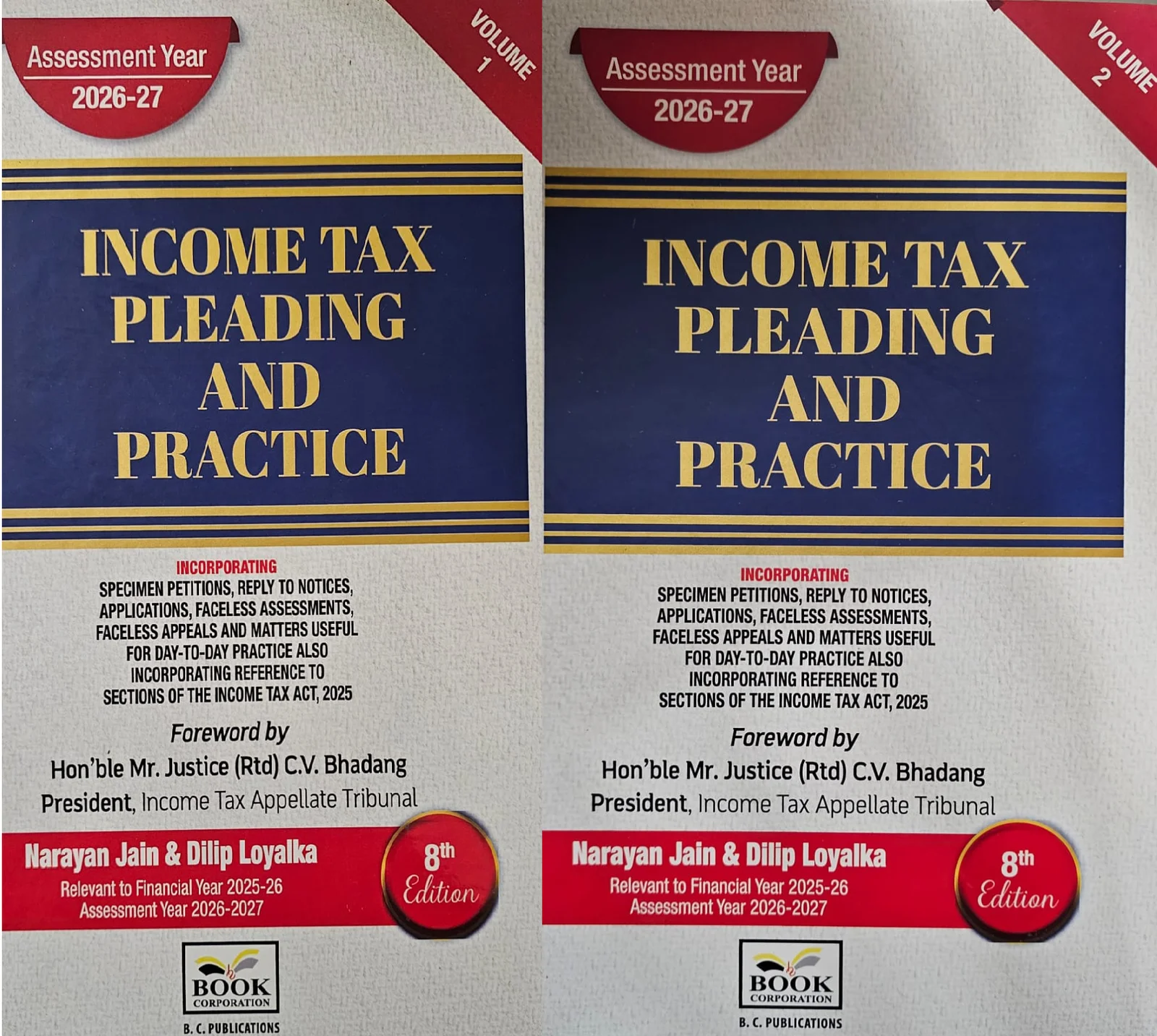

Income Tax Pleadings and Practice by Narayan Jain and Dilip Loyalka (Set of 2 Vols.) – 8th Edition 2026

Original price was: ₹6,995.00.₹4,495.00Current price is: ₹4,495.00.

Income Tax Pleadings and Practice by Narayan Jain and Dilip Loyalka (Set of 2 Vols.) – 8th Edition 2026

Description

The subject of Income Tax is usually treated as complex and any summons or notice from the Income Tax Department generally causes tension in the minds of taxpayers. In view of this reality, we have made sincere effort to present this book for proper and effective compliance of various notices issued by NFAC for Faceless Assessments/ Appeals or Notices issued by jurisdictional Assessing officers. The book has been presented in a simple and lucid manner. In addition to the basic provisions of relevant sections, the matter relating to each notice has been dealt with incorporating the decisions of Hon’ble Supreme Court, High Courts and ITAT; CBDT Circulars & Notifications. We have incorporated specimen reply to each such notice for ready reference of the tax professionals and readers. Corresponding Sections of the Income Tax Act, 2025 has been mentioned in chapter headings/appropriate places.

In this book we have added Highlights of the Finance Act, 2025, as well as Issues relating to Faceless Assessments/ Appeals to acquaint our readers with the latest amendments in law. In addition to providing ample material on effectively handling assessments, re-assessments and revisions, we have dealt elaborately on filing of appeals before the CIT (Appeals), ITAT, High Court and the Supreme Court. Specimen Grounds of appeals, Statements of facts on various issues as also specimen of Paper Books, Memorandum of Appeal and Petitions before the High Court and Specimen of Writ petitions have also been placed in this book. It would be handy in effective pleading as well as representation before the appellate authorities. For the convenience of readers, we have further included in the book, Annexures which cover new Tax Rates, Depreciation rates, rates of Gold and Silver, Cost Inflation Index, Due Dates for furnishing Income Tax Returns, Time limit for filing appeals, Revision Petitions etc

Content of the Books as follows –

Volume 1 :

Part – A : Dealing with Notices issued by the Income Tax Authorities with Specimen Reply

Volume 2 :

Part – B : Drafting of appeals, Cross – Objections, Revision Petitions, Settlement application, Application for Advance uling etc..

Part – C : Specimen of Indemnity Bonds, Guarantee Bonds, Gift Deeds, Partnership Deed , Will & Useful Applications.

Part – D : Specimen of Useful Agreements & Power of Attorney.

Part – E : Tax Rates , Appeal Fees , Court Fees, Stamp Duty, Depreciation Rates, Gold & Silver Rates , Cost Inflammation Index & Other Important Information.

Additional information

| BINDING | Hardcover |

|---|---|

| AUTHOR | Narayan Jain and Dilip Loyalka |

| EDITION | 2026 |

| ISBN | 9789395613750 |

| PUBLICATION | BOOK CORPORATION |

Reviews

There are no reviews yet.